Published 22 June 2021

Singapore-based start up Kashtec offers a solution to help small businesses in the Asia Pacific region to release trapped working capital – the tokenization of trade credits. Part of the Hinrich Foundation's series on the Future of Trade, Kashtec CEO George Lee explains the enormous economic potential that could be unleashed by trade tokens and credit scoring.

This interview is part of the Hinrich Foundation Future of Trade Interview series.

Small businesses comprise the bulk of the global economy and are its unsung heroes. Unfortunately, with their working capital ‘trapped’ in a stream of invoices, too often they barely survive. According to a report by the International Finance Corporation, some 131 million small and medium sized enterprises (SMEs) face unmet financing needs of US$3 trillion. In ASEAN alone, SMEs endure a US$300 billion funding gap. For millions of SMEs, this trapped working capital holds back business expansion or even basic operations.

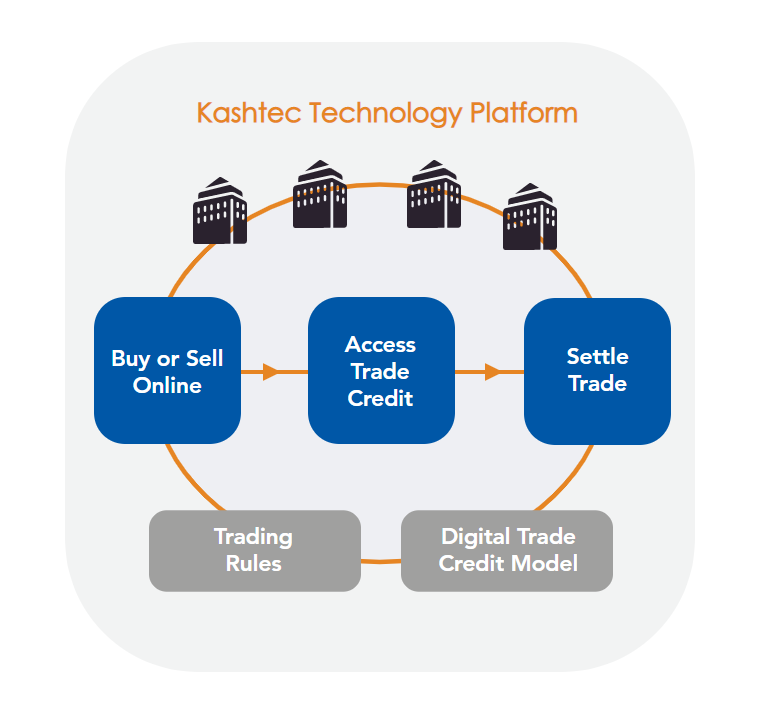

Singapore-based Kashtec offers a solution in the form of digital ‘tokens’ that can be traded for cash and ease liquidity. The tokens are traded through two platforms. With Kashcorp – which powers its own operated communities called BBX – a business that joins the community is assessed with a scorecard that determines how much trade credit it can use to purchase goods and services from other members. Suppliers also receive trade credits through the platform, which record the accounting movement in credits.

With Kashbanc, a partner bank issues a digital token on the invoices it accepts, which suppliers can cash out when needed. The tokens serve as the basis of transaction for suppliers, buyers and the intermediary bank.

The business model is rooted in the concept of community shared by Kashtec’s 20,000 business members across 11 countries. With representatives in Australia, China, India, New Zealand, Malaysia, and Thailand, Kashtec has the potential to be a game changer for trade and economic growth. The platform’s 15,000-plus transactions per month are also a data trove that allows for strong credit scoring.

The Hinrich Foundation recently interviewed Kashtec CEO George Lee to learn more about the tokenization of trade credits, reportedly the first of its kind in the world. Here are portions of the interview, edited for clarity.

Q: What is the problem that Kashtec is trying to solve?

The credit that exists between buyer and seller is a perennial problem. Often you have a buyer who wants to pay as late as possible and a seller who needs payment as early as possible. That tension will always remain.

The question is how to convert trade credit into something that could source financing. A seller must ensure enough cashflow to finance the raw materials to manufacture the products to sell to buyers. The same is true on the buyer side. Unfortunately, SMEs have less infrastructure and capabilities to ensure they have the right financial statements, documentation and processes that enable better financing terms. Financial institutions perceive the SME as higher risk.

What can we solve? We took tokenization and the available technology and applied it to trade credit. It removes the funding gap, makes credit immediately transferable, and enables the parties to use that trade credit without waiting to be paid.

Q: Why don’t you have competition in this space?

We have competition in different aspects of what we do. Kashtec requires an ecosystem that is a digital marketplace, where this tokenization of trade credit is accepted. We compete with traditional B2B marketplaces. We compete with traditional sources of financing. But as an integrated solution, which combines the marketplace with a supply chain financing solution, and with a factoring solution through the use of our tokens – no one has done that globally.

But it is a matter of time before more businesses adopt the model.

Q: You welcome the competition?

Yes. The space is huge. An estimated US$5 trillion of trapped working capital exists globally between buyers and sellers. That is more than enough space for everyone. Competition is good. It brings about more innovation.

If you are a bank, we give you the opportunity to use our technology to supplement your traditional lending. If you are an SME, the opportunity is to use your trapped working capital. If you are a large buyer, use our platform to identify better quality suppliers. If you are a regulator and policymaker, it is important to look at alternatives. SMEs require funding not just for capital requirements – they live and die by working capital.

Q: What are your three biggest challenges?

It is a chicken and egg situation. When we present to potential target users, they ask, “Am I the first? How many members do you have on your platform?” Scale and adoption are our biggest challenges. We must achieve a certain scale at speed, otherwise investors and the community may lose interest.

Secondly, we differentiate between those who align with our objectives versus those who approach it from perhaps a more selfish perspective. Sometimes they hear our pitch and create their own versions, which would be great if those pitches are shared. Sadly, they often take a competitive rather than a community approach.

Lastly, even if people are convinced, often they think that technology can solve everything. They think, if I adopt this, I will get more customers and more funding. They imagine that it is a magic formula. It is important to manage their expectations.

Q: Who has heard your pitch?

We have spoken to banks and business associations. We should demonstrate proof of value at a commercial level before taking it to policymakers. We are under no illusion that we can replace the financial system – we are trying to complement the system. The funding gap exists because the financial system has checks and balances that were put in place for good reasons. We cannot take that away.

Q: How do you build trust in your ecosystem?

We have two models. Kashcorp, or BBX, is a pure peer-to-peer funding model. Kashbanc is backed by a financial institution, which becomes the guarantor of trust. Whatever token is being exchanged is backed. Technology here helps. Blockchain helps to address and decentralize trust in an intermediary.

If you were a buyer on our platform, how are you assured that you will receive the goods that you paid for? If you are a seller, how do you ensure that you will be paid. Banks have letters of credit and step in as the intermediary of trust. Banks absorb the losses in the case of a default. How do we replicate that insurance within our ecosystem? That is where the data comes in. The technology enables us to have the information required for a credit insurer to step in.

We are starting with the first phase, which is essentially a peer-to-peer insurance. We are ensuring that you have enough data to demonstrate the reliability of a buyer and seller. On a B2B level, you want to know that this buyer pays on time and has a good history of making

purchases. If a buyer has been purchasing product category A, and suddenly they purchase product B, you may ask, “Is this a true transaction?” That information is contained within our ecosystem.

Q: What does this ecosystem look like?

It is essentially a scoring system. You can build more layers into it, starting with the most basic, which is payment timeliness. Buyers want to know if delivery is timely, and the product is correct. These are two critical points that we track on our platform. The more information you provide, the more trust you create within the community.

You want to know that you will be paid on time. That information today is not available to businesses. They do not have information about how other businesses are behaving. We have that for consumers, similar to reviews on Amazon.

Q: What about cross-border trade?

Cross-border trade is a very small volume of the business but an area that we want to expand. The model and technology are agnostic to location. Currently, our set-up is more domestically focused. Maybe partly because most SMEs we work with buy and sell domestically. Maybe Singapore is an exception and some of the countries in Asia that are more export oriented. But Kashtec has a large merchant base in Australia and very few transactions go cross border.

Q: How do you explain that?

It could be the result of self-selection. The SMEs we are working with tend to be at the lower end in terms of annual revenue and be domestically focused. The services sector that we work with, restaurants and hair salons, are also domestic in nature.

But there are no restrictions when it comes to cross-border. The same model can apply. If you have a community of businesses on the platform, their location does not matter if they have transaction capability enabled by the tokenization of trade credits.

Q: Wouldn’t the system be constrained by regulations?

The system has a very narrow purpose – tokenizing the trade credits. You treat it as just another mechanism. An invoice and purchase order are still required but when accepted are simultaneously converted to tokens and can be used immediately rather than waiting for a payment.

We should spend more time with the regulators demonstrating the model to keep in mind that we are not a currency. We cannot speak for regulators and how they would like to treat the tokenization of trade credits. We are merely digitizing an accounting treatment that already exists.

Q: How do you scale it up for cross-border trade?

We would like to demonstrate for a specific corridor or industry. Then our efforts would be more focused. Prior to the political situation, we were in discussion in Myanmar to form a national B2B marketplace as a first step. The marketplace would then be connected to major trade partners, for example, Singapore.

For partners like China, we want to look at specific sectors such as agriculture or the garment sector, on which a significant part of the Myanmar economy is dependent. They would need to source materials from other countries and sell to traders here in Singapore

and Europe. We want to establish those trade corridors for the platform – buyers can then assess the quality of suppliers from Myanmar. Smaller suppliers can also aggregate their selling capacity to bid for contracts that cannot be bid on an individual basis.

Countries like Malaysia, Indonesia and the Philippines can establish platforms for specific sectors. For example, a community of mango producers in the Philippines would include mango producers, processed food producers, shippers, and traders. Then we look for mango purchasers here in Singapore.

We want to pick specific corridors and industries and demonstrate the value. We want to identify the right partners. That is how we want to scale. We have big ambitions that require a lot more resources. It is better to move forward in phases.

Q: Where do you see Kashtec in ten years?

Amazon started as a bookseller that digitized the experience for the customer. It has evolved. Similarly, we want to start with the narrow – the tokenization of trade credits. In ten years, if we do not expand into other areas, we would be a regional ecosystem that enables the supplementation of SME financing. If we can take just a part of ASEAN’s US$300 billion funding gap, it will go a long way toward creating many more jobs and supporting a lot more families.

The scale of the problem is so large that there must be more than one player. We would be bubbling over with joy if we could be a part of that journey.

For more information, visit https://www.kashtec.com/.

***

Read more from the Future of Trade Interview Series:

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).