Published 14 November 2023

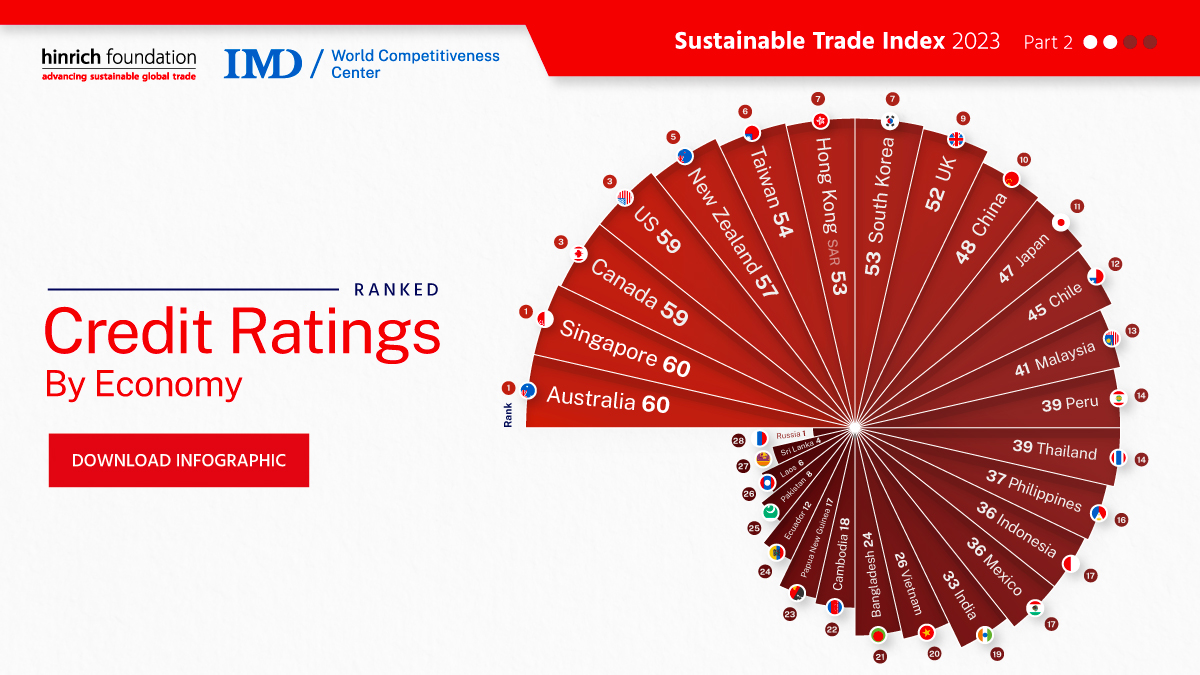

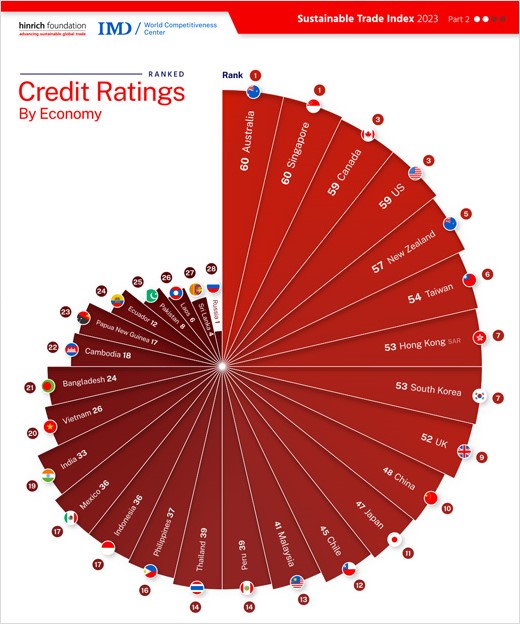

Maintaining a strong credit rating can lower an economy’s borrowing costs and strengthen investor confidence. Based on the findings of the 2023 Hinrich-IMD Sustainable Trade Index, Visual Capitalist illustrates how credit ratings differ across 28 major economies. Australia tops the chart, while Russia, perhaps not surprisingly, comes last.

(Text by Chuin Wei Yap)

One of the key pillars of economic stability essential to global trade is the creditworthiness of a trading economy.

Credit ratings are an important measure of how much an economy can borrow, essentially representing the market’s forward-looking opinion on the relative ability of the economy to meet financial commitments – in other words, the likelihood that it is able to repay its debt. They don’t necessarily mean a recommendation or endorsement for investment purposes, but rather signal the economy’s level of credit risk for traders and investors.

The Hinrich-IMD Sustainable Trade Index includes credit ratings as one of 71 indicators we use to measure how well an economy is positioned to sustainably conduct global trade. The index ranks 30 key economies including the Asia-Pacific, the United States, China, the United Kingdom, and Latin America, against a framework of economic, societal, and environmental policies. The index acts as a blueprint for governments, businesses, and communities to shape strategies and policies that integrate their global trade in ways that promote the prosperity and sustainability of their economies.

As Visual Capitalist shows in this illustration, the second instalment in a series that will showcase the findings of the 2023 Sustainable Trade Index, Australia tops the chart in creditworthiness. It has a long record of stable and peaceful political systems, strong governance institutions, and well-established rule of law, and low corruption.

In fact, most of the economies that scored well on this indicator tend to be stable, democratic, and developed economies. Singapore, Canada, the United States, and New Zealand followed Australia, in order, in the ranking. China, Chile, Indonesia, and Vietnam sit in the middle tier in terms of ranking scores.

Russia, perhaps not surprisingly, is at the bottom of the ranking. Moscow defaulted on its foreign debt last year, the first time since 1918, as its economy reeled under the weight of international sanctions imposed in response to President Vladimir Putin’s invasion of Ukraine. There are arguments that the default was a technicality, since Russia wasn’t able to pay in dollars due to US and European Union sanctions, but the incapability to pay was itself a reflection of the geopolitical realities of Moscow’s own making.

The Hinrich-IMD index includes other economic indicators such as consumer price inflation, labor force participation, foreign direct investment, trade liberalization, tariff levels, and others. They are increasingly key indicators as the global trading system is experiencing the most severe era of geopolitical and economic fragmentation in 70 years.

Credit ratings, in themselves, include factors such as current account balance, debt payment history and timeliness, banking and financial operations, future economic outlook, and national economic strength.

These rankings, blended from Moody’s, S&P Global, and Fitch ratings, remain key to understanding the intense geoeconomic changes ongoing in our world.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).