NPF webinar | What’s Next in the US-China Trade War?

Published 23 June 2020

The fourth briefing in a webinar series by the National Press Foundation focused on what to watch for next in the trade war. Speakers explored how journalists can best cover US-China trade tensions and the struggle for geo-economic dominance.

Share this video on Twitter, LinkedIn, and Facebook.

Tit-for-tat tariffs now tack on about 20% to the cost of US and Chinese exports, and US-China trade relations are likely to remain fraught no matter who wins the White House in November.

In this briefing, three experts said journalists covering the issue can dig into data about who has been harmed most – and they should also tell the story of how globalization could be unraveling. Experts included:

- Huiyao (Henry) Wang, PhD, Founder and President, Center for China and Globalization (CCG), and Counselor, China State Council

- Mary Lovely, Senior Fellow, Petersen Institute for International Economics (PIIE)

- Bob Davis, Senior Editor, The Wall Street Journal

Bob Davis, senior editor at The Wall Street Journal and coauthor of the new book “Superpower Showdown: How the Battle Between Trump and Xi Threatens a New Cold War,” said China’s decision to expel US journalists based in Beijing will worsen public understanding of the critical issues dividing the superpowers. Davis described the US-China relationship as a “romance gone bad.” The year 2008, when the two nations worked together to pull the global economy out of recession, was the high-water mark.

The downward spiral in the relationship preceded the election of President Donald Trump and some degree of disengagement will likely continue whether or not Trump is re-elected in November, he said. While a President Joe Biden would likely be softer on China rhetorically, he would be unlikely to repeal a tariff regime that now affects most Chinese imports without extracting concessions from Beijing in return, Davis said.

However, the tariffs that were meant to hurt China most have in fact hit US manufacturing supply chain hardest, argued Mary Lovely, Senior Fellow at the Peterson Institute for International Economics and a professor at the Maxwell School of Business at Syracuse University.

Lovely described the US tariffs as an “own goal,” a soccer term that refers to a player shooting into their own side’s goal and giving an embarrassing boost to their opponent. While the administration’s initial goal was to combat intellectual property theft and protect American manufacturing jobs, its policies have instead hurt manufacturers and jobs, she said.

Chinese importers absorbed the tariffs, but the tariffs did not protect US jobs, Lovely said.

The original policy of forcing China to buy more from the United States is now evolving into one of forcing “decoupling,” or the disengagement of the US and Chinese economies. Although China lost 4% of the US market for tariffed goods, the gap was quickly filled by Mexico, Vietnam, the European Union and Taiwan. Supply chains won’t come back to the United States unless the barriers and costs are very high, Lovely said.

Both Lovely and Wang agreed that China has been lagging in meeting the targets for importing US goods that were agreed on under Phase 1 of the US-China trade deal. That’s mostly due to the pandemic, they said. The goal is a $200 billion increase in US exports of energy, agricultural manufacturing and other goods to China over the next two years.

However, Wang, founder and president of the Center for China and Globalization, said China did step up its imports sharply in the first quarter of 2020. It imported more than $5 billion in US agricultural goods, up 110% compared with 2019, Wang said.

With the pandemic, China has become an even more important trading partner for the US, because China is still growing while other world economies are shrinking, Wang argued. In April, US trade with China rose more than 40%, while its trade fell with Mexico, Canada, India, France, Israel and Russia, at a decline of between 40% and 49%, Wang said.

Download expert slides from this webinar:

|

|

|

Media resources: US-China trade issues – Bob Davis |

Status report on the US-China trade war – Mary Lovely |

|

|

| The future of US-China relations – Henry Huiyao Wang | |

***

This briefing is part of a series of National Press Foundation's online webinars on global trade issues in the era of the coronavirus. Check here for all past briefings. Trainings explored:

- US trade policy under a Biden administration

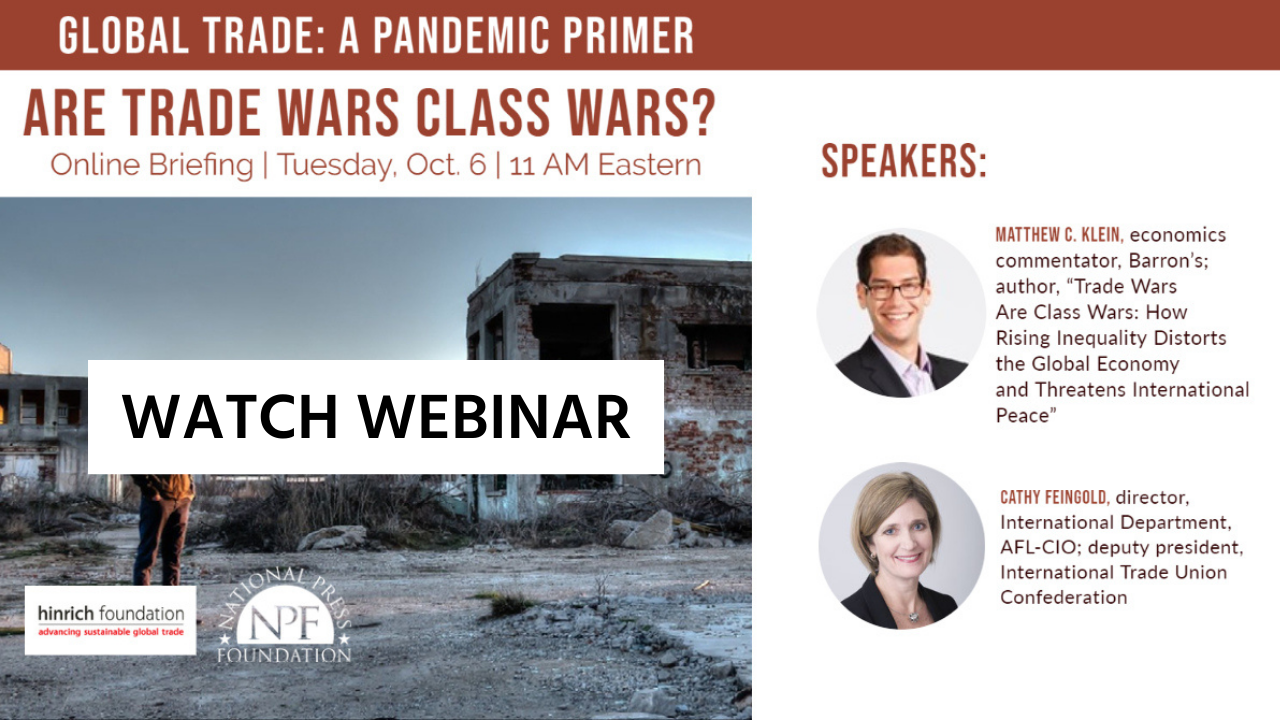

- Are trade wars class wars?

- The new digital trade war on data

- Future of the WTO under Biden or Trump

- Managing the new US-China cold war

- Will China's dominance in raw materials imperil the US?

- US-China battle for technological and geopolitical dominance

- Medical trade wars

- Food security during the pandemic

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).