Reviving FDI's transformative power

24 August 2021

Published 24 August 2021

Border barriers on foreign direct investment (FDI) remain extensive in many APEC economies on the grounds that certain FDI contravenes ‘national interest’. But this ill-defined concept could obscure the economic and developmental gains that such investment can bestow.

Since the early 1990s, international trade growth has persistently eclipsed foreign investment growth in the Asia-Pacific. Over this time Asia-Pacific trade in goods and services expanded on average at 7.1% per annum nearly twice as fast as GDP growth at 3.7%.[1] This trade growth has reflected APEC’s priority in liberalising international trade over foreign investment.

However, in the past decade international trade growth in the region has slowed, corresponding more closely with GDP growth.[2] This presents an opportunity for foreign investment in APEC to make up for the trade slowdown and play at least as important a role in economic development. Greater cross border investment within APEC and between APEC and the rest of the world can and should play a greater role in regional economic development.

Generations of economists have argued that free trade in goods and services improves economic welfare. A corollary of their arguments is that trade restrictions, especially in the form of tariffs and quotas on imports, reduce economic welfare because they impose additional direct costs on consumers and indirect costs on exporters.

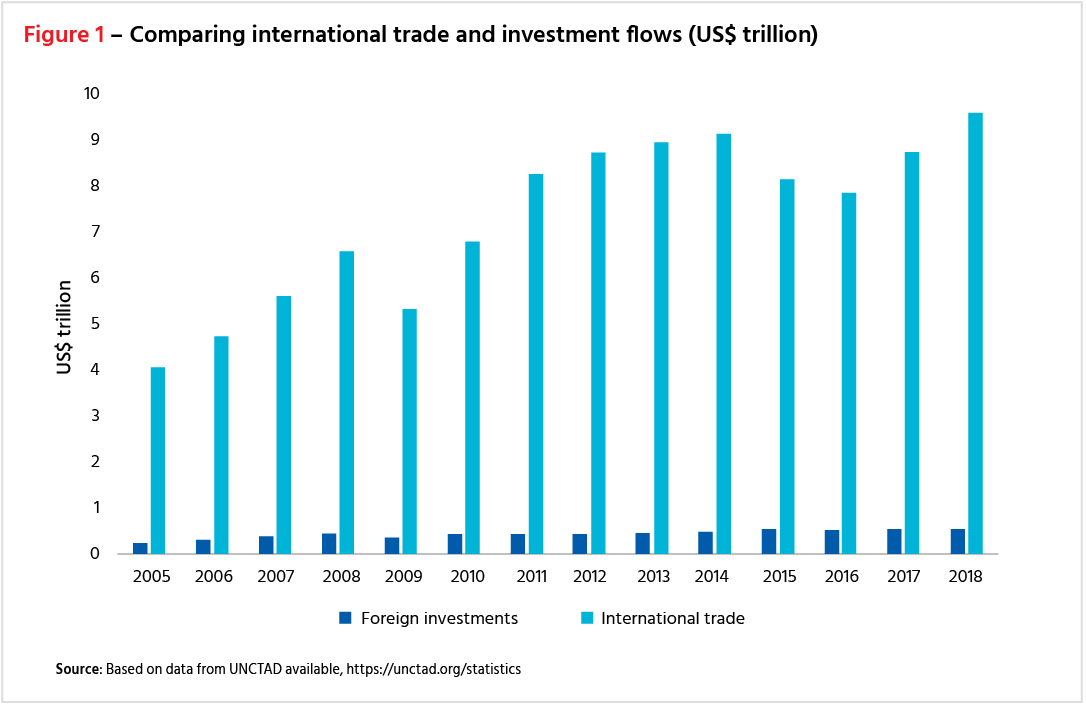

APEC has successfully promoted liberalised and expanded international goods and services trade. Much less attention has been paid to liberalising cross-border investment flows, despite the 1994 APEC Bogor declaration that called for “free and open trade and investment in the region”. This is evident when comparing the value of international (exports plus imports) with foreign investment (inward plus outward).

According to United Nations Conference on Trade and Development (UNCTAD), from 2005 to 2018, total FDI in Asia has ranged between a mere 5 to 8% of total trade in goods and services, exports plus imports. See Figure 1.

Figure 1 - Comparing international trade and investment flows (US$ trillion)

What distinguishes foreign investment flows from international trade flows is their inherent volatility. Portfolio investment flows are highly volatile due to their susceptibility to speculative pressures. FDI flows can also vary considerably more than trade flows from year to year, due to the ‘lumpy’ nature of large-scale investment projects and sizeable one-time mergers or acquisitions of domestic firms.

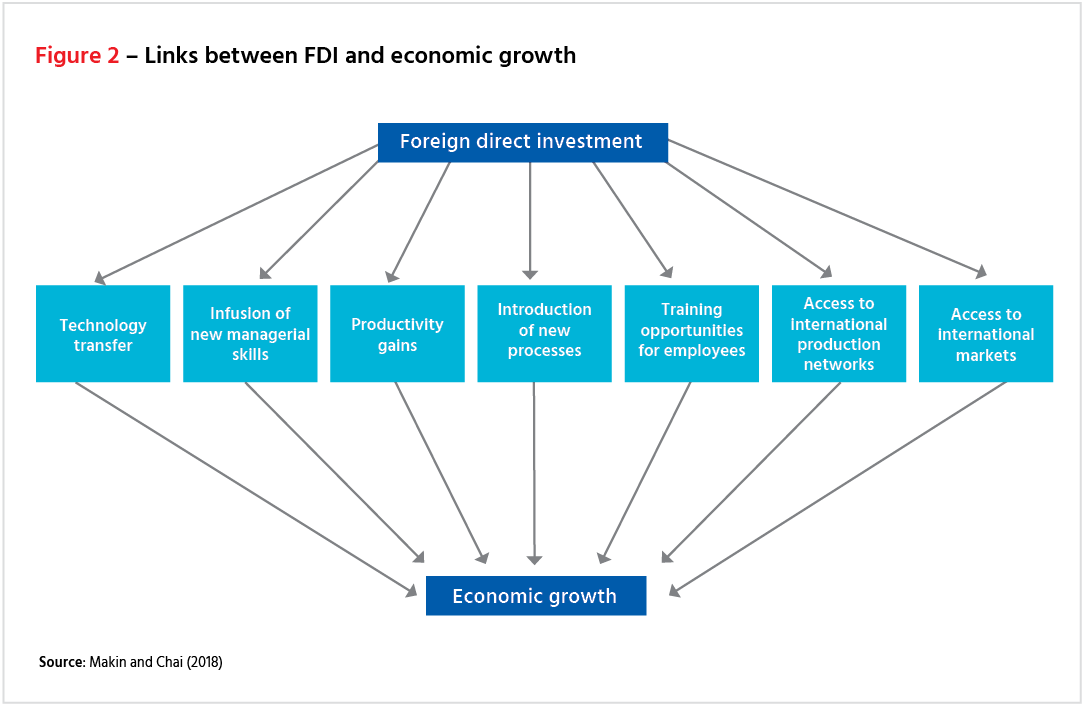

A range of microeconomic and macroeconomic arguments support FDI as a means of raising national income and living standards.[3]

FDI involves the establishment of subsidiaries of foreign multinationals (MNCs) or takeover of domestic firms. MNCs directly and indirectly generate productivity benefits through the transfer of technology and product development.

Furthermore, domestic employees of foreign-owned firms are exposed to international management practices and the presence of new entrants in domestic markets stimulates imitative behaviour and acts as a spur to greater competition. In turn, higher labour productivity allows domestic wages to be higher than they would be with a smaller capital stock.

Some have expressed concern that FDI, in the form of foreign takeovers, or acquisition of real estate by non-residents, results in the loss of control of established domestic firms. Against these economic nationalist concerns, however, are economic benefits which accrue to the residents. Critics of foreign investment generally do not appreciate that whenever residents purchase domestic financial or real assets, the quantum of funds available to residents for additional spending is supplemented as a result of the asset sales.

When foreigners buy existing local assets at higher prices than resident buyers would be willing to pay, the residents who sell such assets to foreigners make capital gains. The proceeds of the sale may be used to create new domestic assets, for consumption, or to acquire new foreign assets.

For example, proceeds from selling an Australian-based domestic manufacturing business to US buyers yielding more than an Australian takeover could be redirected to investment abroad in a start-up company located in Thailand.

In essence, foreign inward investment measures how much capital foreigners are willing to invest in an economy's future with positive effects on the scale of domestic investment, production, and consumption. Meanwhile, foreign investors can earn higher income investing in host economies than at home should the return on the capital deployed exceed the return on that capital in their home economies.

Figure 2 below summarizes the various microeconomic channels through which FDI enhances economic growth and living standards.

Figure 2: Links between FDI and economic growth

Foreign dominance of certain industries could result from merger and acquisition (M&A) activity which in turn could limit domestic competition in those industries. However, this can be addressed by domestic competition authorities treating the foreign owned firms no differently from domestically owned firms.

For example, assume a foreign supermarket chain invested heavily in a host nation to the extent that it acquired a dominant share of the domestic market. Under these circumstances, the national competition authority (such as the United States Federal Trade Commission or Australian Competition and Consumer Commission) would enforce its governing legislation promoting competition and fair trading in that market for the benefit of domestic residents.

Similarly, there could be problems with transfer pricing by multinational firms. Transfer pricing distorts reported profits across tax jurisdictions, usually by overpricing imported inputs to subsidiaries to minimize tax liability in host economies. But this too need not be an issue for foreign investment policy per se, but a matter for the domestic taxation authorities. Tax authorities have devised and applied rules to limit tax minimisation by transnational companies in this way.

In addition to the above microeconomic benefits, there are important macroeconomic benefits that stem from foreign direct investment in particular. For example, when Caterpillar invests in building a production facility in China and then exports all or part of its production from China, China's GDP benefits from the exports and the economy also benefits from the capital inflow. China also benefits

from receipt of intellectual property, from the upgrade in management skills training, and through distribution channels that Caterpillar had already established.

This is not an isolated example. A very substantial portion of inbound foreign direct investment in Asia is to support a multinational company's exports globally. This is true in industrial products, consumer products, automobiles, auto parts and many other goods and services. This kind of FDI has a greater impact than an acquisition of an existing business.

Investment by thousands of foreign companies has contributed greatly to China's economic success.[4] Vietnam has experienced the same kind of dynamic growth due to this type of investment.

According to national accounting conventions, an economy’s use of foreign saving or net inward foreign investment equals the gap between investment and savings. Hence, for economies that experience net capital inflow, an increase in a country’s capital stock is partly financed by domestic saving and partly by foreign investment. There is another way of thinking about the macroeconomic significance of foreign investment: it allows an economy to consume more while meeting saving levels required to fund its investment needs.

In sum, at the macroeconomic level, for net capital importers, FDI is reflected in the capital account surpluses which match the regular current account deficits of the host country. The more foreign investment an economy attracts, the higher its foreign liabilities. However, as long as the returns from the extra physical capital are greater than the servicing costs on FDI, national income can grow faster than otherwise. For economies experiencing net capital outflow, national income is also higher than otherwise to the extent that the return on investment abroad exceeds the return on investing that capital at home.

In short, foreign capital inflow in aggregate improves an economy’s economic welfare – it frees it from the constraint of its own saving level. The amount of additional economic activity in a range of domestic activities would not be as great, Overall, foreign investment can improve national income growth in both host and source economies.

The huge difference in scale between trade and investment flows suggests that regulatory barriers are severely limiting FDI. To the extent that these barriers are discouraging cross border investment flows, growth in APEC is therefore potentially sub-optimal.

Barriers to foreign investment can be defined as any government policy measure which distorts decisions about where to invest and in what form. They include policy measures that limit the level of foreign investment, create the need for firms to endure costly application fees, and time-consuming screening processes required to convince national authorities that projects are in ‘the national interest’. The main barriers are ‘border restrictions’ and they include:

Most APEC economies adopt some form of screening or registration of foreign investor along with restrictions on levels of foreign ownership of domestic firms. Case-by-case judgments by government bodies are widespread in the region as are limits on ownership, managerial control, and board membership, especially in sectors such as telecommunications, broadcasting, and banking.

In addition, other government policy settings indirectly inhibit FDI by worsening the investment climate via high corporate taxes, and the lack of protection for intellectual property.

Increased foreign investment could conceivably play as important a role in economic development as increased international trade in goods and services. Trade in assets and investment allows funds to move to places where capital can be used most productively. The greater the international trade in assets, the greater are the potential economic welfare gains.

Further liberalising cross border investment in the Asia-Pacific would significantly improve national income and living standards throughout the region. These include productivity gains due to technology transfer, international management practices, imitative behaviour by locally owned firms and improved domestic competition. At the macroeconomic level, freer foreign investment in APEC would unshackle economies with unrealised investment opportunities from the constraint of their own saving levels.

As identified above, border barriers are extensive. Considerable scope therefore exists for liberalising foreign investment policy regimes in Asia-Pacific economies. In many cases, economies argue that foreign investment in the financial, manufacturing, media, real estate, and transport industries is either heavily regulated or prohibited in most APEC economies, on the grounds that foreign ownership in these sectors contravenes the ‘national interest’.

On the contrary, presenting an ill-defined concept as a rationale to deter FDI obscures the economic gains that such investment can bestow.

[1] Based on data in APEC Regional Trend Analysis (2021) available at https://www.apec.org/Publications.

[2] APEC Regional Trend Analysis (2021).

[3] The remainder of this paper draws on Makin, A. and Chai, A. (2018) “Prioritizing Foreign Investment in APEC Global Economy Journal 18 (3).

[4] https://www.hinrichfoundation.com/research/wp/fdi/impact-of-us-fdi-in-china/

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).

Message contents