Foreign direct investment

Foreign investment has helped to deliver growth in Southeast Asia – can it also deliver sustainable development?

Published 05 October 2022

Beyond capital and jobs, foreign direct investment (FDI) has made significant contributions to sustainable development in Southeast Asia. Yet, the benefits of FDI have not been felt evenly across economies and societies; it can even create risks of irresponsible business practices. In a challenging time of diminishing global investment flows, policymakers also need to ensure that FDI confers sustainable rewards.

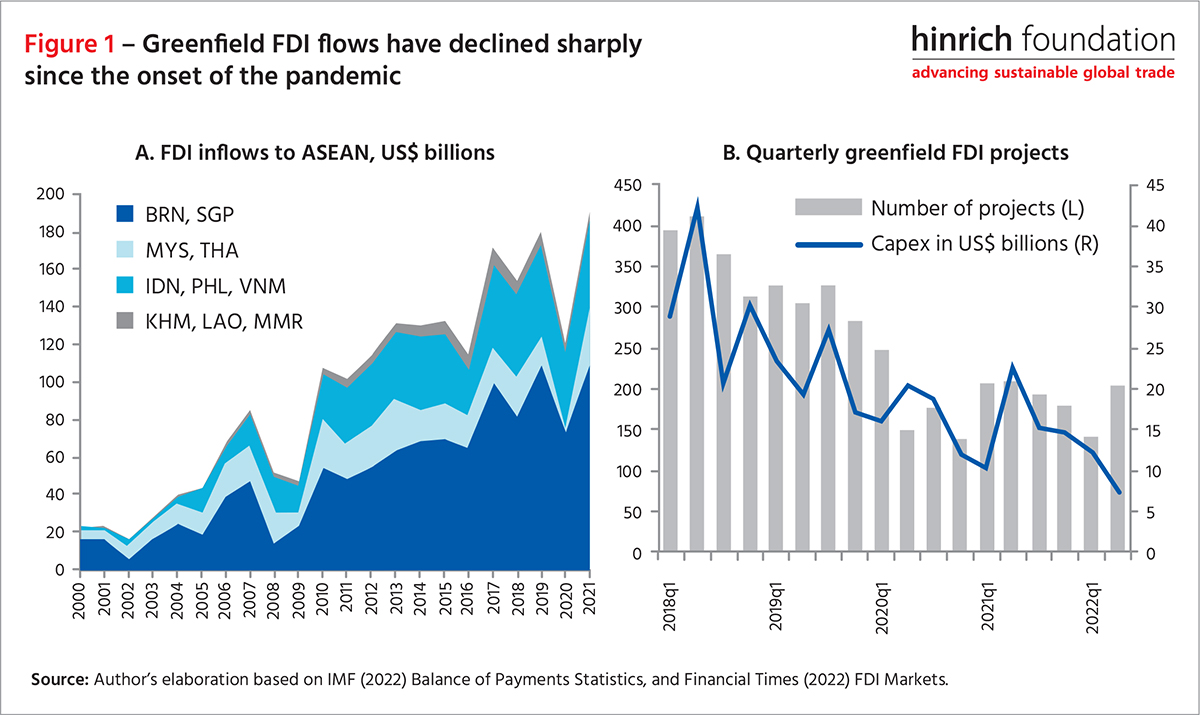

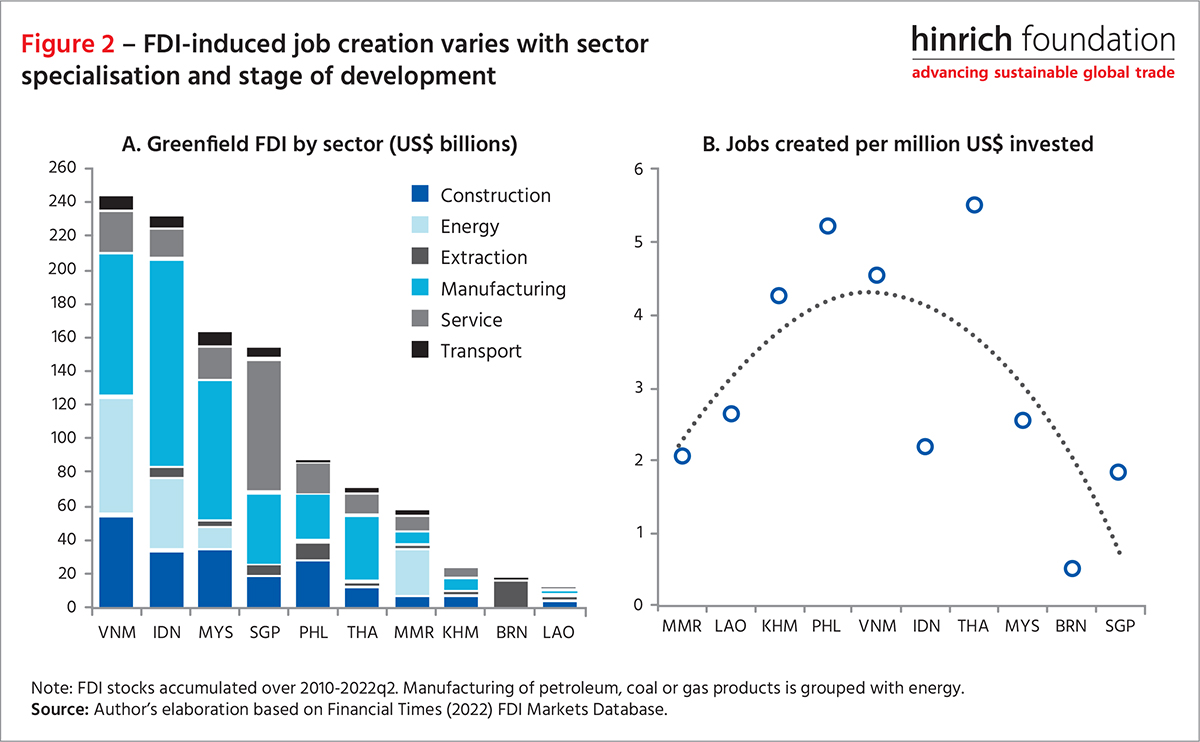

Southeast Asia has been among the biggest recipients of FDI among emerging regions, as some countries in the region were early movers in the shift towards export-led development based in part on FDI. FDI flows to Southeast Asia have increased by a factor of nine over the last two decades, with over half of these going to Singapore which tends to act as the regional hub for many investors (Figure 1.A). Nevertheless, new “greenfield” investment projects have seen a major decline since the onset of the Covid-19 pandemic, with no signs of improvement yet (Figure 1.B). Within the region, Viet Nam and Indonesia have attracted the greatest stock of greenfield FDI over the last decade (US$232-242 billion), followed by Malaysia and Singapore (US$153-164 billion) (Figure 2.A).

Governments in Southeast Asia devote ample resources to attracting FDI with the hope of creating jobs. Greenfield FDI projects generate on average three direct jobs per million USD invested in the region (similar to the worldwide average), but the intensity of job creation varies substantially across countries according to their level of development and economic structure (Figure 2.B). Lower-income countries, such as Myanmar and Lao People’s Democratic Republic (PDR), as well as countries with abundant fossil fuel resources, such as Brunei Darussalam, tend to attract considerable FDI in natural resource extraction and energy generation, which creates relatively few direct jobs. Emerging economies with solid and diversified industrial capabilities, such as Viet Nam and Thailand, create the most jobs per dollar invested. Countries with highly skilled labor forces, advanced industries, and relatively larger financial sectors, such as Malaysia and Singapore, attract FDI in high-tech products and knowledge-intensive services, which require fewer workers. The high capital intensity of manufacturing FDI in Indonesia is driven by the metals and chemicals industries, while the high labor intensity of FDI in the Philippines is driven primarily by business support services.

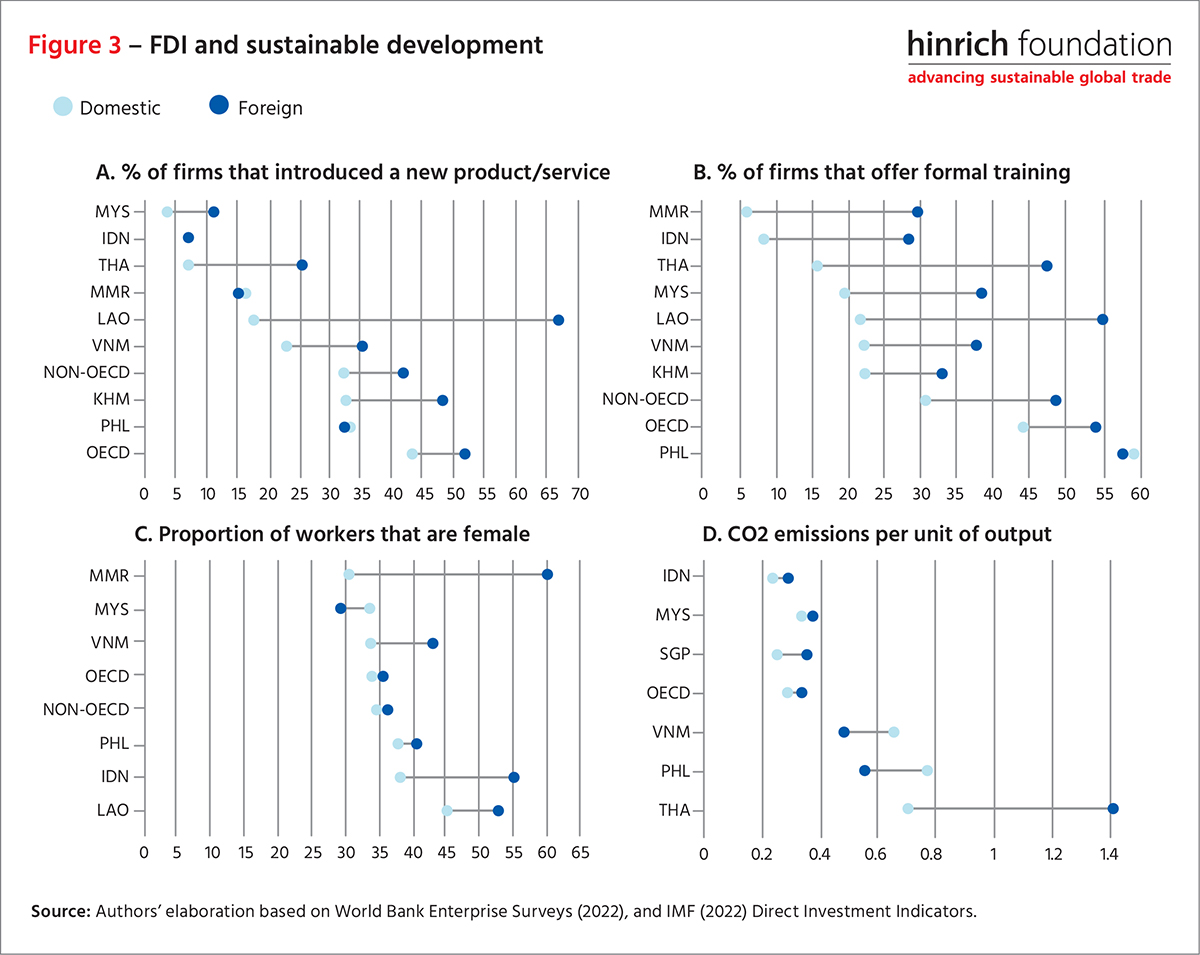

Beyond capital and jobs, FDI has made significant contributions to sustainable development in Southeast Asia. Significantly more foreign firms introduce new products and services than their domestic counterparts across most countries in the Association of Southeast Asian Nations (ASEAN), and this greater innovation capacity suggests that there is potential for knowledge and technology to spill over to domestic firms (Figure 3.A).

Foreign firms are also more likely to offer training opportunities to their employees, and the gap between foreign and domestic firms is considerably larger in many ASEAN countries than in the average OECD or non-OECD country, suggesting that foreign firms contribute disproportionately to on-the-job skills development in the region (Figure 3.B). By employing larger shares of women in their workforces in most ASEAN countries, foreign firms also help improve gender equality in the workplace (Figure 3.C).

Yet, some economies have benefited more than others, and the benefits of FDI have not been felt evenly across different parts of society. While FDI creates jobs and contributes to upgrading skills and raising living standards, it can also create risks of irresponsible and unsustainable business practices and worsen income inequality, potentially leaving vulnerable segments of the population behind.

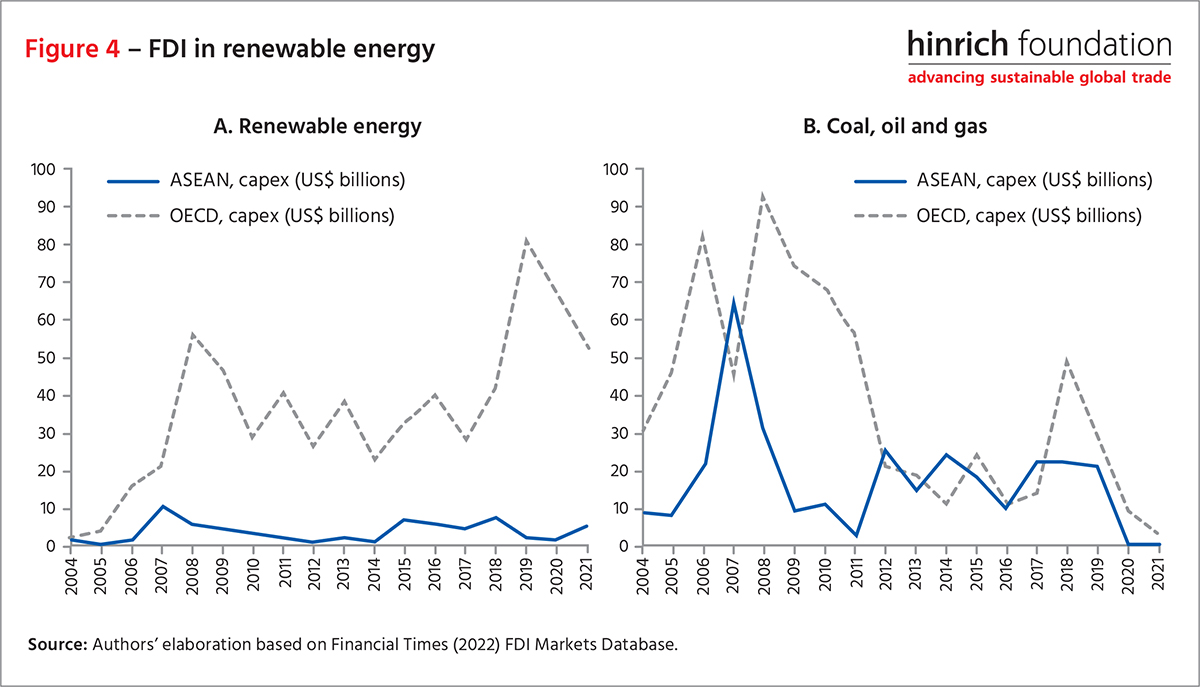

The contribution of FDI to green growth and decarbonization is not clear-cut. In Indonesia and Thailand, for example, FDI performs poorly relative to domestic investment in terms of CO2 emissions per unit of output, particularly in the extractive, metal and energy industries, whereas in Viet Nam and the Philippines, the carbon footprint of FDI is lower than that of domestic investment, particularly in energy and manufacturing industries (Figure 3.D). FDI’s shift away from fossil fuels and into renewable energy in Southeast Asia has also lagged behind that of other regions, and varies considerably across the region (Figure 4). In Lao PDR and Cambodia, renewable power attracted more than half of new foreign investments in the energy sector in the last decade; yet fossil fuels still account for over 88% of energy FDI in six ASEAN countries.

As in the case of other major crises, the Covid-19 pandemic has created momentum for ASEAN governments to revisit the fundamentals of their economic policy and reorient their priorities towards more resilience and sustainability. Promoting sustainable investment is an integral part of the ASEAN Comprehensive Recovery Framework (ACRF) and its implementation, which is defining broad strategies to respond to the crisis in a coordinated and long-term manner.

The challenge for governments is not just to attract foreign investors at a time of diminishing global FDI flows, but also to ensure that the investment confers sustainable benefits on the host economy. Attracting investment and reaping the maximum benefit in terms of sustainability depend first and foremost on the overall policy framework in which investment occurs. Policymakers need to maintain a sound, transparent and open investment climate, and adopt policies that ensure the benefits of FDI are maximized and their potential harm on the local economy, society and environment are minimized. Furthermore, targeted promotion tools and measures to enable responsible business conduct (RBC) are equally important for a sustainable investment framework. This requires whole-of-government efforts, evidence-based policy-making and meaningful stakeholder consultations.

Investment promotion agencies (IPAs) should also adapt their strategies to their governments’ sustainability objectives and adopt targeted indicators to select priority investments and to measure FDI sustainability outcomes. In ASEAN, while the sustainable development goals count as one of the top factors influencing IPAs’ priorities, only three IPAs use sustainability-related indicators to measure the impact of their activities. Targeted and well-designed incentives can also be powerful tools to attract FDI with sustainable value-added, especially investment that can contribute to the low-carbon transition; but existing incentive packages for carbon-intensive industries can dampen the effectiveness of green incentive schemes.

Enabling RBC is an equally important part of the equation for governments to promote sustainable investment by creating conditions that favor responsible investors, improve attractiveness for high-quality investors and protect resources for the future. Investors with strong RBC risk management frameworks are also better equipped to identify, assess, and address risks in their supply chains.

A forthcoming report by the OECD will provide analysis on ASEAN governments’ efforts to attract sustainable investment and what they can further do to promote the benefits of investment for social and environmental objectives. Building on the strong and long-lasting cooperation that the OECD enjoys with the ASEAN Secretariat and the ASEAN Coordinating Committee on Investment, the report will use OECD tools such as the Policy Framework for Investment, the Guidelines for Multinational Enterprises and Due Diligence Guidance for RBC, the FDI Qualities Policy Toolkit, Indicators and Recommendation, as well as a survey on sustainable investment promotion.

By providing a comparative analysis of investment policy reforms and investment promotion priorities, indicators to measure the sustainability impacts of FDI, ways to enable responsible business conduct, policy initiatives to promote green investment and examples of good international practices, it is hoped the report will help ASEAN Member States in their efforts to implement the sustainable investment component of the ACRF. The findings could also assist in the development of tailored ‘ASEAN sustainable investment guidelines’, which ASEAN Member States are currently considering.

***

Learn more about the OECD’s work on sustainable investment and FDI qualities.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).