Published 24 August 2021

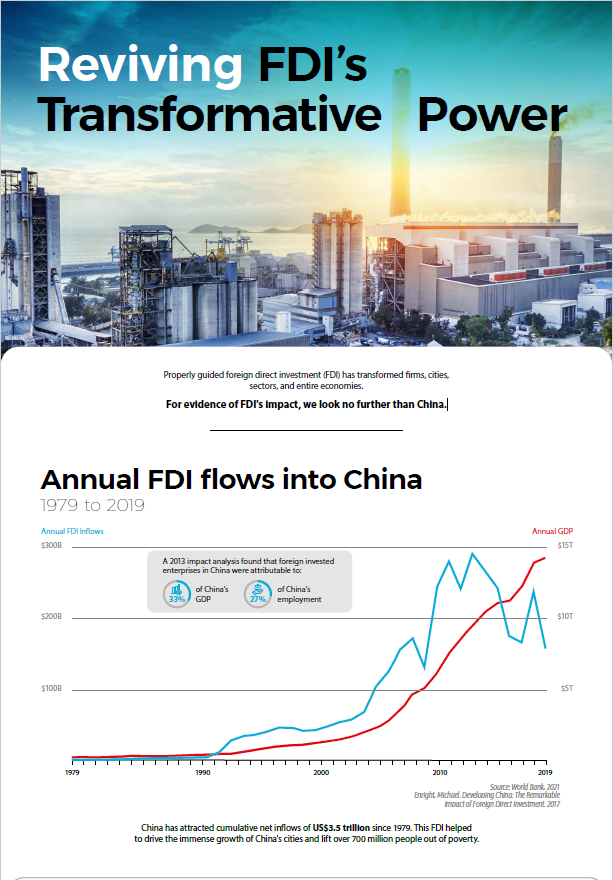

Foreign direct investment (FDI) has been transformational for the global economy, in particular for the Asia Pacific region. For evidence of FDI's impact, we look no further than China in our latest infographic.

In many countries, FDI outperforms aid, remittances, and portfolio investments as the largest source of external financing. The investments create jobs, boosts incomes and productivity, improves management expertise, and spurs technology transfer.

The spillover effects of FDI have led to better working conditions and environmental practices. Industries modernize, supply chains emerge, infrastructure develops, as do regulatory reforms. The impact of FDI is often larger than the initial investment. For example, research supported by the Hinrich Foundation estimates that, during the mid-2010s, around one-third of China’s GDP was generated by the investments, operations, and supply chains of foreign invested companies. These impacts have helped China become the world’s second largest economy, its leading exporter, and a leading destination for investment.

FDI has suffered a steady decline in recent years, both in aggregate and in developing countries, despite its potential to boost economic recovery. Instead, restrictive policies such as FDI screening have increased.

Download "Reviving FDI's transformative power" infographic:

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).

Related articles

Advancing sustainable development with FDI: Why policy must be reset

03 June 2021

Advancing sustainable development with FDI: Why policy must be reset

03 June 2021