Trade distortion and protectionism

India’s PLIs and their impact on foreign investments

Published 28 February 2023

India’s production-linked incentives (PLIs) have long been viewed as crucial to vaulting it up the global value chain. There’s just one hitch: The evidence suggests a liberal investment policy designed on free market principles might be just as good an incentive architecture, if not better, for attracting foreign capital as PLIs.

New Delhi’s PLIs were a set of industrial policies introduced at the outset of the pandemic, aimed at drawing foreign investments in strategic industries. A key policy goal was to reduce India’s high import dependencies,[1] including its heavy dependence on China for several intermediate and final good imports, particularly in electronics, pharmaceuticals, and solar modules. Policy makers in Delhi fear supply chain disruptions could create import shortages and affect domestic availability. The fears were compounded by India’s strained political relations with China creating possibilities of its import dependence being used against Delhi’s geopolitical interests.

The PLIs are part of a global wave of financial incentives to redraw global investment routes along geopolitical priorities. The US is doing so under the Inflation Reduction Act (IRA), 2022,[2] and the CHIPS and Science Act[3] of 2022, for mobilizing investments in domestic manufacturing of clean energy products and semiconductors. A few months after the outbreak of Covid, Japan announced incentives for its businesses for shifting production out of mainland China.[4] These incentives, like India’s PLIs, are efforts to enlarge domestic capacities and encourage the reshoring of supply chains for preventing disruptions from pandemic-like catastrophes or geopolitical tensions.[5]

Have India’s PLIs been successful in attracting foreign investments? Well, yes and no.

The ‘yes’ part of the answer

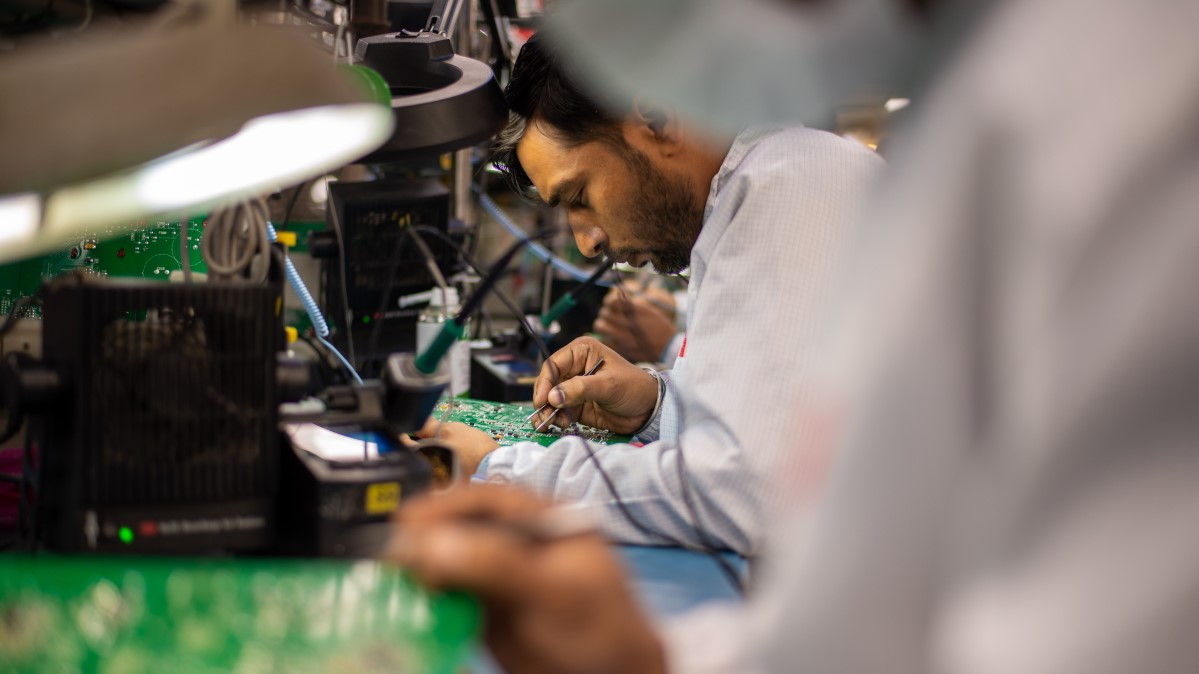

Beginning with three industries (pharmaceuticals, electronics, and medical devices) in March 2020, the PLIs were expanded to cover another ten industries in November 2020.[6] So far, smartphone manufacturing has received the best response. Production of iPhones has taken off rapidly in India. All of Apple’s major contract manufacturers[7]—Foxconn, Pegatron, and Wistron—are using the PLI scheme to make iPhones in India. The success has inspired the government to consider expanding the scope of PLI in electronics for broadening the electronics manufacturing eco-system in the country.[8]

Encouraging Apple to make more of its products, such as MacBooks and iPads, out of India, requires establishing large parts of these supply chains within India. A major challenge in this regard is to attract vendors supplying various components in the supply chains to India. The PLIs have not yet demonstrably succeeded in securing these vendors.

India is also looking at PLIs for encouraging semiconductor making facilities in the country. The Vedanta-Foxconn collaboration[9] for making semiconductors in India’s western state of Gujarat is being looked at as a good start in this regard.

But PLI schemes in other industries have not been able to attract big-ticket foreign investments to date. The users of PLIs in these industries have been confined to domestic businesses. The prospects for foreign direct investments (FDIs) in these industries are unclear.

The last three years have drawn robust FDI inflows into India, contributing to India’s economic development. In the fiscal years 2019-20, 2020-21, and 2021-22, India received US$56 billion, US$54.9 billion, and US$56.2 billion of FDI respectively. These three years stand out as the best FDI years for India[10] since the beginning of the century.

However, it is difficult to attribute these flows to the PLIs.

The ‘no’ part of the answer

A close look at the sectoral distribution of incoming FDI[11] for the last three years shows computer software and hardware, which captures investments in IT and IT-enabled services, including business-processing outsourcing (BPO) having received the most FDI[12], followed by construction (infrastructure and real estate projects), services (e.g., financial, banking, insurances, outsourcing, R&D) and trading (retail and distribution services.) None of these sectors have PLIs.

The robust flows of FDI in the non-PLI sectors can be significantly explained by the abilities of Indian start-ups in fintech, edtech, e-commerce, and healthcare to attract foreign investments. With more than 100 unicorns, India now has one of the biggest start-up ecosystems[13] in the world attracting significant foreign funds. As more tech start-ups come up, they would create avenues for more investments. However, these investments would be outside the scope of the PLIs.

The government is toying with the idea of bringing more sectors under the PLI scheme. From a government perspective, the initial success of PLIs for smartphones has been an important factor in contemplating the extension of PLIs to more industries. On the other hand, domestic industries, which are not yet covered by PLIs, have begun demanding these incentives. A generous attitude in expanding PLIs to more sectors could be risky as it means increasing subsidies without certainty on whether the incentives will eventually yield more taxes through higher future revenues from the new capacities created.

Will extending PLIs to more sectors attract more foreign investments?

The fundamentals behind the evaluation

The question assumes importance at a time when India, along with the US, Japan, and Australia, is trying to financially incentivize foreign investments, including through efforts to “friend-shore” supply chains and enhance trade partnerships. An initiative like the Indo-Pacific Economic Framework for Prosperity (IPEF) that includes India and its major Indo-Pacific partners can be a source of major foreign investments for India. India would be eyeing the IPEF as a source of foreign investments for hosting strategic supply chains, similar to the way it has been able to expand domestic iPhone-making capacities.

Three IPEF members, Singapore, the US, and Japan,[14] are among the largest sources of inward FDI into India. These countries account for 23%, 9%, and 6% of the total FDI that has come to India since 2000. Korea has also been an important source of FDI into India, particularly in automobiles, though as a proportion, Korean FDI is less than 1% of India’s total FDI.

India would be looking at these countries to continue investing in various sectors. But PLIs, while always handy, may not complement India’s natural advantages as a destination for long-term investments.

PLIs and incentives like it being offered by other countries are efforts to lure foreign investments through financial support. However, financial incentives might not be necessary for attracting foreign investments. In India’s case, this is evident from the success of its start-ups in attracting foreign investments without the support of PLIs.

Apple’s efforts to ramp up iPhone production in India can be attributed to India’s appeal as a major global market for iPhones. The efforts have also been influenced by the availability of Indian workers skilled in assembling iPhones. The rise in global uncertainty and US-China tensions would’ve also impacted Apple’s decision to diversify production and reduce reliance on mainland China as its core assembling location. The PLI scheme complemented the decision given that it is offering financial support on incremental sales from new investments. Sales of iPhones in India are sure to increase in the foreseeable future. The new capacities created can also be used for exporting iPhones from India to elsewhere in Asia and Africa.

All the above factors might not necessarily apply to other industries with PLIs. In industries like drones and drone components, specialty steel, solar PV modules, or telecom, the prospects of incremental sales, from the perspective of potential foreign investors, might not be as promising as those for iPhones. These industries might also be lacking adequate skilled domestic labor for using new capacities. PLIs, by themselves, therefore, might not be enough for attracting investments in these sectors.

In contrast, the success of non-PLI sectors like trading, construction, IT services, and financial services to attract FDI, underscores their enduring appeal from a foreign investors perspective. A large chunk of incoming FDI in India is motivated by the pull of its various services industries, particularly those that are adapting to digital deliveries, such as e-commerce, retail, healthcare, and education. In these sectors, domestic sales prospects are bright given India’s young population, rapid urbanization, and a burgeoning middle-income class that is going digital in lifestyle and habits at an exceptionally fast pace. These trends also explain the bright prospects for Apple’s iPhones in India as well as that for construction services, such as urban real estate facilities and logistics, which are also attracting investments.

Inflows depend on simplification, not distortion

PLIs, till now, have been chosen for industries, many of which appear to be unconnected to the above trends except for smartphones and some segments of electronic manufacturing. The core objective of the PLIs is to encourage investments in creating local capacities so that India can substantially reduce its critical import dependencies in several manufacturing items. The focus on reducing import dependencies might have overlooked understanding of whether the import-dependent sectors are appealing to foreign investors.

India liberalized its FDI policy easing FDI regulations significantly in 2020 by reducing restrictions on foreign investments in strategic industries like defense production, airports, e-commerce, railways, construction, insurance, pharmaceuticals, telecom, and petroleum. India’s current FDI policy allows most industries to receive FDI through the automatic approval route without investors requiring prior permission. The policy has produced results, notably a significant rise in FDI inflows during the last couple of years.

The liberal FDI policy should result in even more inflows if it is accompanied by greater procedural simplifications and lesser regulatory requirements for new FDI projects. More PLIs might not be necessary.

***

[1] Production Linked Incentive (PLI) Schemes, Invest India

[2] The Inflation Reduction Act: Here’s what’s in it, McKinsey

[3] CHIPS and Science Act Will Lower Costs, Create Jobs, Strengthen Supply Chains, and Counter China, The White House

[4] Japan to offer incentives to companies shifting base from China to India: Report, Mint

[5] Reshoring and “friend-shoring” supply chains, Deloitte

[6] The last industry to be made eligible for PLIs was drones in September 2021.

[7] After iPhones, India eyes MacBook production, may boost incentive scheme, The Times of India

[8] Here's what IT minister Rajeev Chandrasekhar has to say on "made in India" smartphones, The Times of India

[9] Vedanta clarifies semiconductor manufacturing to be done by holding company Volcan, Economic Times

[10] Foreign Investment Inflows, Reserve Bank of India

[11] Quarterly Factsheet on FDI inflows from 2000 to 2022, DPIIT

[12] Some investments in large-scale electronics manufacturing, such as making smartphones, might have been partly captured in FDI flows in computer software and hardware.

[13] The Indian Unicorn Landscape, Invest India

[14] Ibid

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).