With many ambitious climate targets to meet, the European Union’s tariffs on Chinese electric vehicles (EVs) could backfire on its environmental goals at a time when the adoption of EVs is just gaining momentum.

The move would negatively impact uptake of EVs through price increase for consumers, undermining trade and environmental cooperation between the EU and China, and stifle innovation in the European automotive sector.

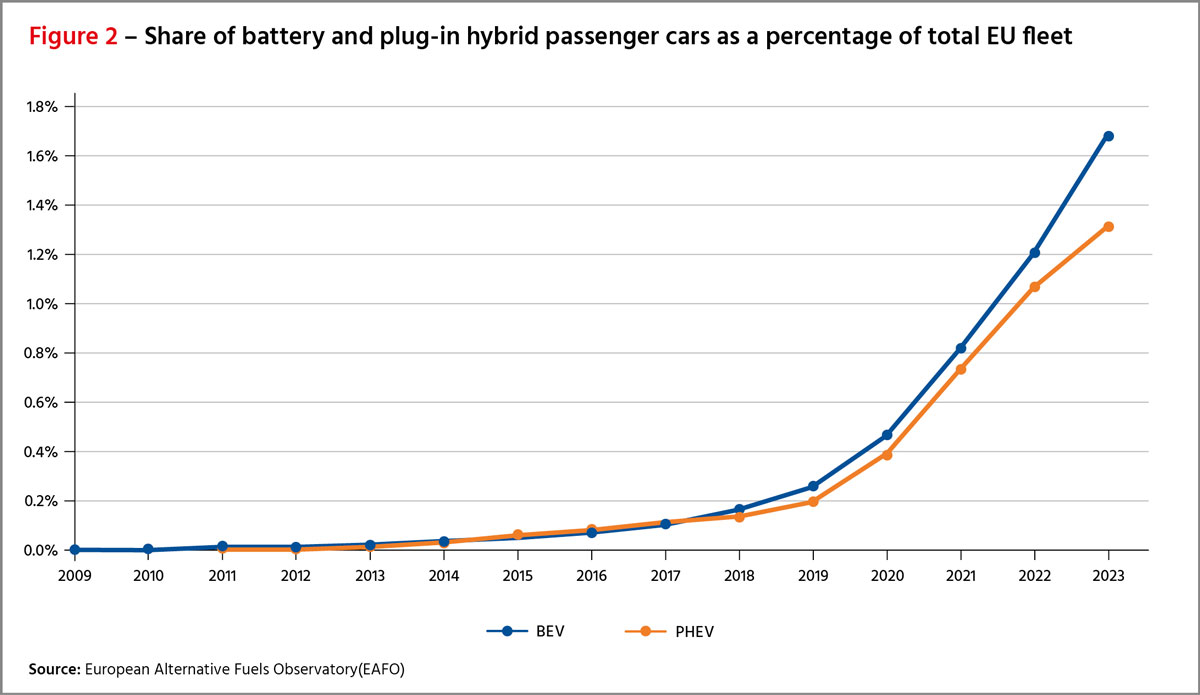

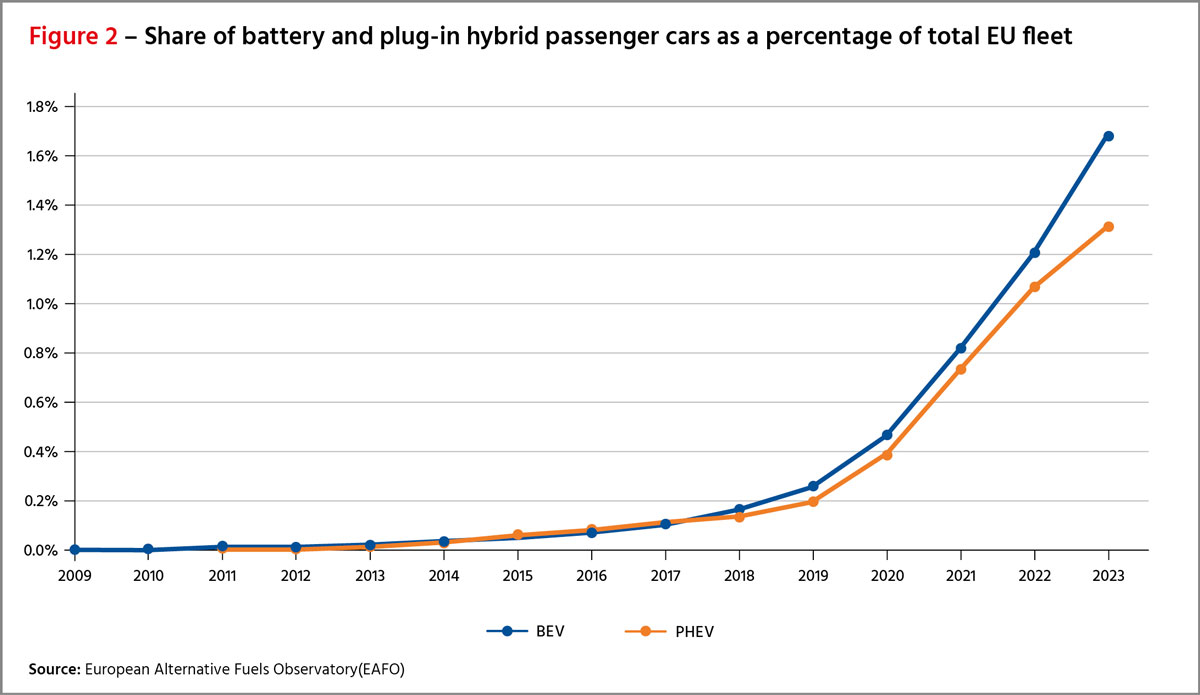

However, Chinese-made EVs already enjoy a large production cost advantage over European counterparts, and the leeway to lower the eventual tariffs render the EU’s levies potentially useless. A bigger casualty of the tariffs on green goods like EVs is the European Green Deal to achieve climate neutrality by 2050 and reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990. The transport sector is a major source of emissions in the EU, accounting for about a quarter of the total emissions. Within the sector, road transport constitutes the highest proportion of overall transport emissions and therefore requires urgent decarbonization. The EU has set targets to reduce carbon dioxide emissions for new cars by 55% from 2030 to 2034, compared to 2021 levels, and to eliminate them completely from 2035.1 It also plans to increase its share of renewable energy sources in transport to 14% by 2030.2

Relying on tariffs to deter foreign competition and protect its domestic green mobility sector will not help the EU meet its climate objectives. It will instead have the following impact:

- Price increases

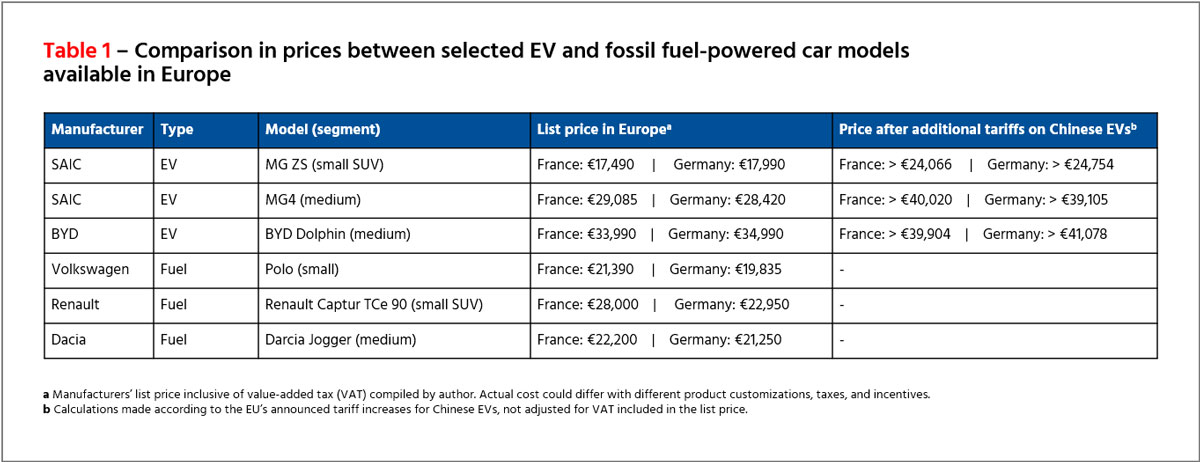

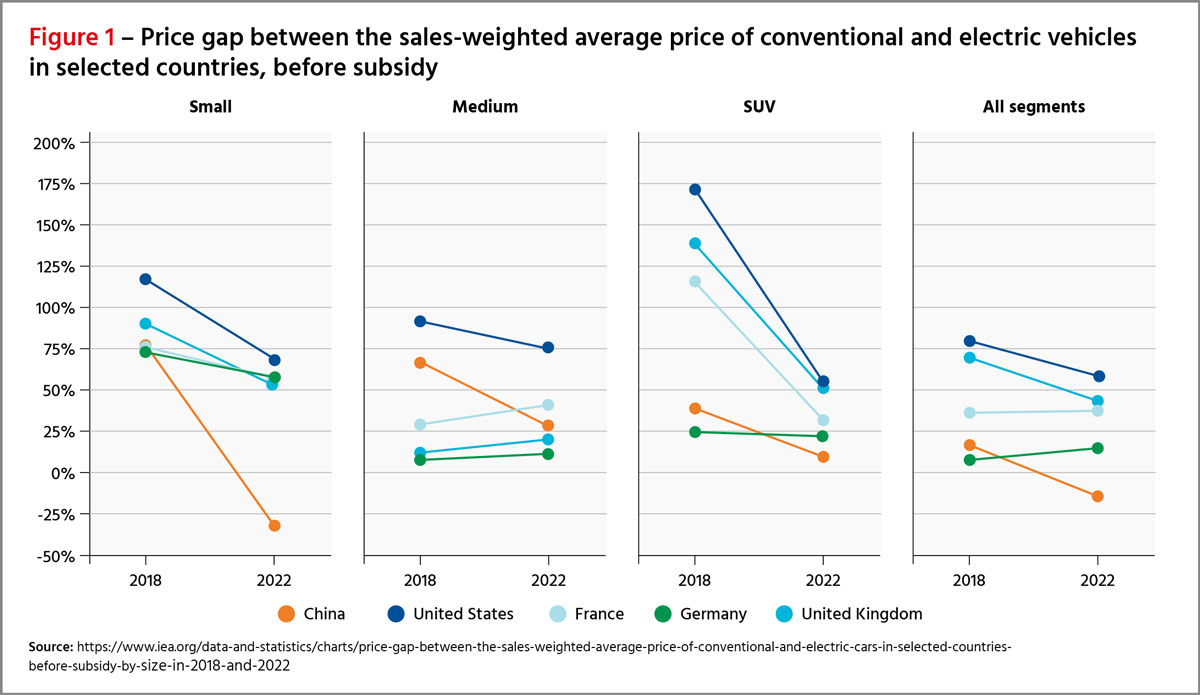

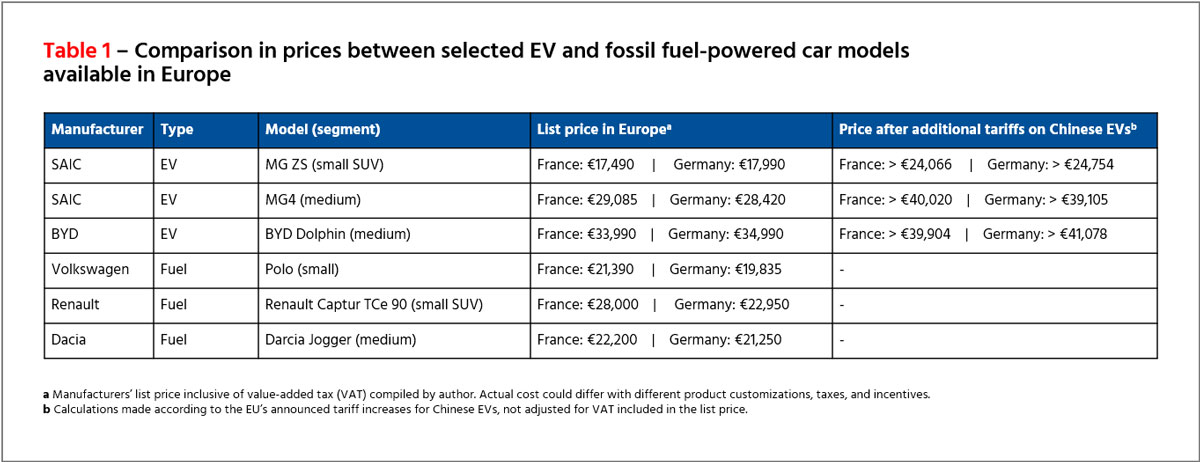

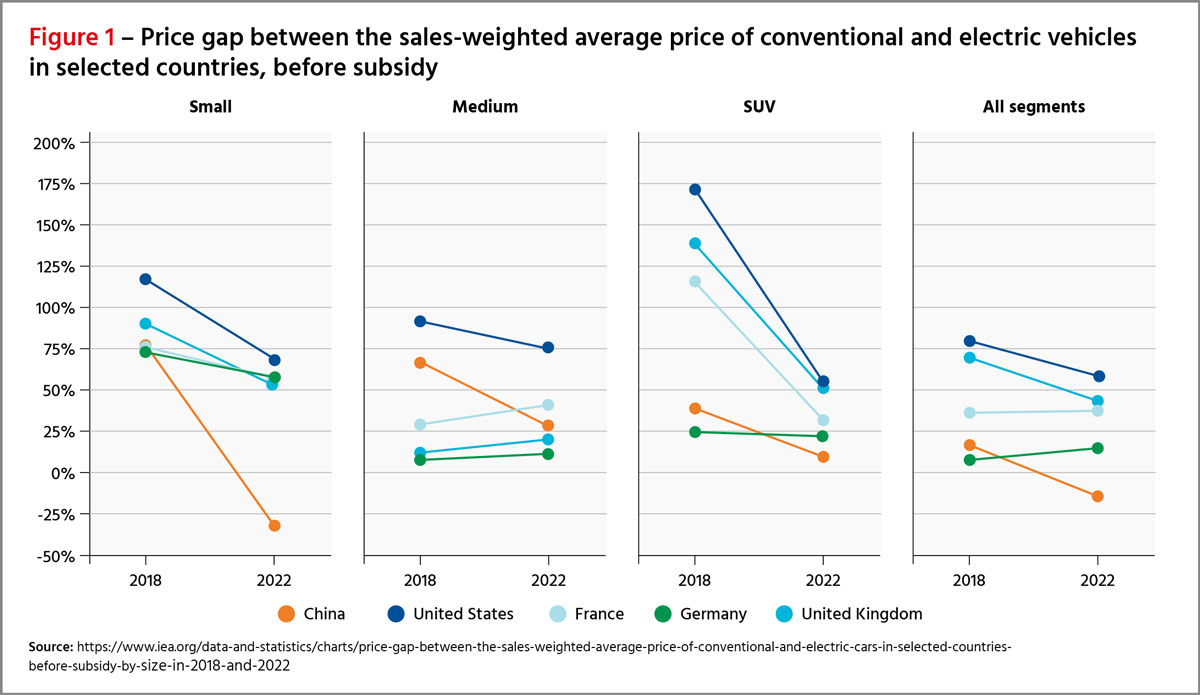

Increased tariffs would make imported EVs more expensive as European distributors can pass on the increased costs to consumers, who end up bearing the brunt of the price increases. This reduces the demand for EVs among European consumers and discourages them from switching away from fossil fuel vehicles. EVs are already more expensive than fossil fuel vehicles at the higher end.

Price increases for EVs after the imposition of tariffs can deter consumers from switching away from internal combustion engines (ICE) vehicles. In contrast to ICE vehicles, EVs face low adoption rates in most European markets where price increases for more affordable models can have a significant impact.

- Undermine cooperation on climate goals

By targeting EVs made in China, the tariffs could escalate trade tensions and undermine cooperation between the EU and China, which are both major players in the global effort to combat climate change. The tariffs could prompt China as a major trading partner of the EU and the biggest producer and consumer of EVs to retaliate by imposing tariffs on European exports such as alcohol and agriculture products or limiting access of European firms to its large and growing EV market. The EU is also probing China’s state support for wind turbine companies, which could also widen to other sectors and further snarl global supply chains and cooperation on green technologies. A possible tariff war between the EU and China stands to harm businesses and consumers on both sides.

- Stifle innovation and competition

Relying on protectionist measures such as imposing tariffs tends to stifle innovation and competitiveness. The EU boasts many automotive manufacturers that have invested significantly in research and development (R&D) for decades, resulting in improved fuel efficiency, reduced emissions, and improvements in the safety of ICE vehicles. These achievements have given European cars a brand value that commands premium prices.4 To preserve such brand value in an era increasingly defined by technology, automation, and artificial intelligence, European incumbent original equipment manufacturers (OEMs) in the automotive sector will need to understand customers’ changing needs and preferences and acquire new technologies to build products that the market wants. Imposition of tariffs to shield European incumbent OEMs from Chinese competition has the potential to disincentivize product innovation that are competitively priced in the European market.

Addressing national-level concerns is key to EU green mobility

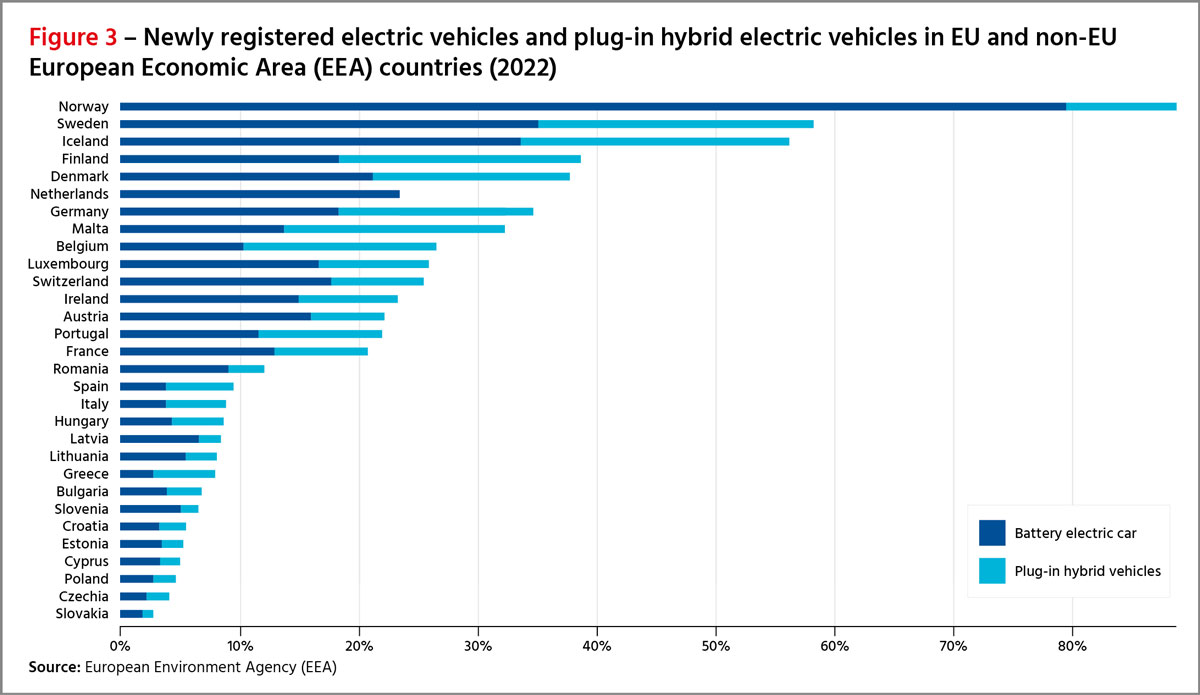

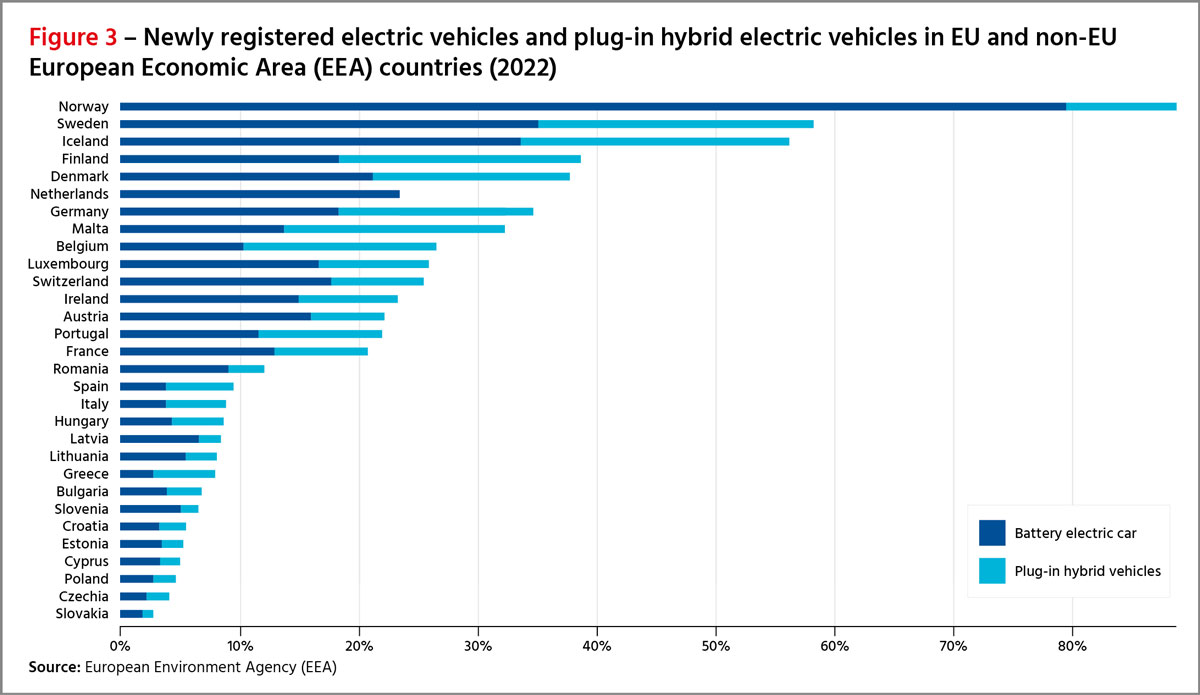

Imposition of tariffs on Chinese-made EVs will have implications on EU member states’ national-level targets for green mobility. Instead, one key approach to advance the EU’s green mobility ambitions is to address a range of domestic concerns among member states that have kept EV adoption rates low for a large number of European countries. Many European countries still lack the necessary infrastructure, financial support, and regulatory frameworks to encourage the uptake of EVs among consumers. This makes them more dependent on imports of cheaper EVs. Increasing tariffs on more affordable EVs simply deters the uptake of EVs.

Many EU member states, particularly in Central and Eastern Europe, have low adoption rates of BEV and plug-in hybrids. Figure 3 illustrates that BEVs and hybrid vehicles in more than half of the EU’s member states each accounted for less than 10% of total passenger fleets in 2022, with Slovakia, Czechia, Poland, Cyprus, and Estonia at the bottom.

While the European Council and Parliament set bloc-wide policies and strategies, each member state has its own policy framework to support the EV industry and adoption. This leads to a fragmented and inconsistent landscape of incentives, regulations, and infrastructure across the EU, which affects the level of EV adoption in different countries5. For example:6

Incentives

- EV subsidies program in countries such as Germany, France, Italy, Austria, and Hungary

- Tax exemption and/or reduction for EV ownership in countries such as Austria, Bulgaria, Germany, Italy, Portugal, Romania, Slovakia, and Sweden

- Charging infrastructure support provided in countries such as Italy, Spain, and Sweden

- Excise duties on fossil fuels in countries such as Italy, France, Finland, and Sweden

Disincentives

- Fossil fuel subsidies in countries such as Portugal, Greece, Cyprus, and Hungary7

- Limited EV charging infrastructure in countries such as Romania, Poland, Malta, Bulgaria, and Croatia8

To facilitate the transition to low-carbon mobility, the EU should consider the diverse needs and situations of its members and provide them with tailored assistance and guidance. The EU should foster cross-border cooperation and coordination on EV policies and standards, and invest in research and innovation to enhance its own EV industry's competitiveness and quality. This would help the EU achieve its climate goals and maintain a fair and balanced trade relationship with China and the rest of the world. The EU should also take into account the substantial manufacturing employment generated by the automotive sector, both directly and indirectly, and develop policies to support labor transition for workers affected by the trend toward vehicle electrification.9

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).