How to use it

Rethinking international rules on subsidies

Published 19 March 2024

From climate change to supply chain disruptions, major economies including the United States increasingly are adopting industrial policy to tackle challenges. Subsidies are a widespread tool. The Council on Foreign Relations provides a report on the rising adoption of subsidies and recommendations for how to reshape international rules.

Here’s how to use the report entitled Rethinking international rules on subsidies.

Why is the report important?

Subsidies have long been an area of concern in the international trading system for their ability to create an uneven playing field distorting trade and competitiveness. Some countries spend hundreds of billions of dollars providing subsidies in order to build globally competitive industries within their own territory. Smaller economies with less spending power cannot compete with such massive government outlays and can be harmed by these policies, which also have the potential to reduce innovation and increase trade tensions. With their increasing use, it is more important now than ever that the world rethink how subsidies are used and agree on new and effective ways to discipline them. This report provides thoughtful and achievable ideas for rules to adopt and issues to consider in developing new disciplines on subsidies.

What’s in the report?

The report includes four principal sections:

Introduction; A global subsidies race

- The United States long rejected use of industrial policy but the Biden administration has embraced it to induce investments in strategically important economic sectors in order to combat, for example, climate change, supply-chain disruptions, and the rise of China; trade policy is increasingly intertwined with industrial policy and subsidies as a tool are growing in importance; the central concerns about industrial policies and use of subsidies remain how to minimize trade frictions and distortions, waste of resources, and harm to innovation while maximizing the common good. (pp. 1-3)

- Industrial policy refers to government efforts to promote specific industries that policymakers identify as critical for national security or economic competitiveness; interventions can take the form of subsidies, tariffs, regulations, tax incentives, government procurement rules, or preferred access to credit; industrial policy can have various objectives, including economic competitiveness, fostering infant industries, national security, and protectionism; the US has historical experience going back to the 18th century in using tools of industrial policy; Biden administration industrial policy uses tariffs and subsidies to “make strategic public investments essential to achieving the full potential of America’s economy”. (pp. 3-5)

- China’s rapid and explosive economic rise has rattled the global economy and unsettled great powers; the Biden administration in turn has called for revitalization of the manufacturing sector and increasing resilience of US supply chains and national security, investing in R&D and training Americans for the jobs of the future; some US officials propose reinvigorating US industry while continuing strategic engagement with China while others argue for strategically using protective tariffs in addition to broad government investment in manufacturing. (pp. 5-6)

- A second focus for industrial policy is fighting climate change; the US’s use of subsidies raises concerns about whether the US has started a global subsidies race in which few countries have the means to participate and whether these “green” policies are a new form of protectionism; US subsidies are sparking discussion on the best way to achieve environmental goals through subsidies as current actions likely conflict with international trade rules. (pp. 6-7)

How to apply the insights

-

This section briefly defines industrial policy and the US’s historical debate over adoption of industrial policy tools like subsidies and tariffs, then quickly moves to explaining the Biden administration’s embrace of industrial policy and their objectives for it.

-

This discussion is useful for understanding current US industrial policy developments and how policymakers around the world should contextualize these moves.

Trade law disciplines on subsidies

- Policy makers and trade negotiators have long been challenged in developing rules on subsidies, as they are common in most economic sectors, used by many economies for many reasons, take many forms, and are provided at different national and subnational levels, with great potential to alter trade and investment flows and undercut support for free trade flows if they appear to unfairly privilege exports from a subsidizing economy. (p. 8)

- Whether and how to discipline subsidies has been a divisive issue since the GATT’s 1947 inception, which only required parties to notify each other of subsidies that could affect exports; the major modernization and expansion of subsidies rules came with the 1986-93 Uruguay Round creating the Subsidies and Countervailing Measures (SCM) agreement. (pp. 8-9)

- Under WTO rules, companies receive a subsidy only if a “financial contribution” that confers a benefit comes from a government or “public body”; the subsidy must be specific to an enterprise or industry in order to be actionable; the SCM agreement allows for two remedies: countervailing duties (CVDs) for injury in a domestic market or a WTO challenge that subsidies are causing serious prejudice in a third-market or in the home market of the subsidy provider. (pp. 9-10)

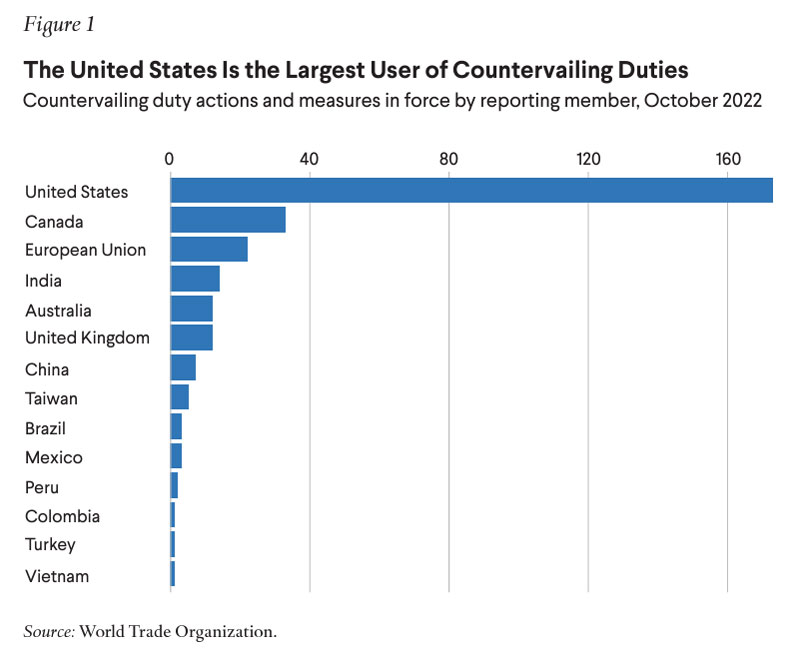

- Concerns persist that WTO rules and the dispute settlement system cannot discipline subsidies due to the narrow definition of “government” and “public body”, the high evidentiary burden in proving the existence of a subsidy; the notification process’s failure to provide sufficient transparency; the ineffectiveness of remedies in disciplining subsidies, and the inability of current rules to distinguish between “bad” and “good” (pp. 10-11, Figure 1)

- The need to police the behavior of state-owned enterprises (SOEs) by applying subsidy disciplines is acute in China given the size and reach of its SOEs; the WTO’s dispute settlement system rejected the contention that China’s SOEs qualify as “public bodies” even though they are owned and controlled by the Chinese government; this decision made it more difficult to impose CVDs or apply subsidy disciplines to SOEs or products containing SOE inputs. (pp. 10-12)

- Aspects of the SCM agreement make it difficult for complaining members to prove that prohibited or actionable subsidies were provided, including 1) demonstrating government control over an entity and 2) showing that a private entity acted at the direction of the government, as obtaining such evidence can be extraordinarily difficult and getting firms to help is challenging if they fear retaliation; 3) proving a benchmark against which to judge whether a financial contribution confers a benefit, which is challenging in countries whose government dominates the economy; and 4) proving that subsidies were the cause of adverse effects, which is the hardest, as many factors can potentially cause such effects. (pp. 12-13)

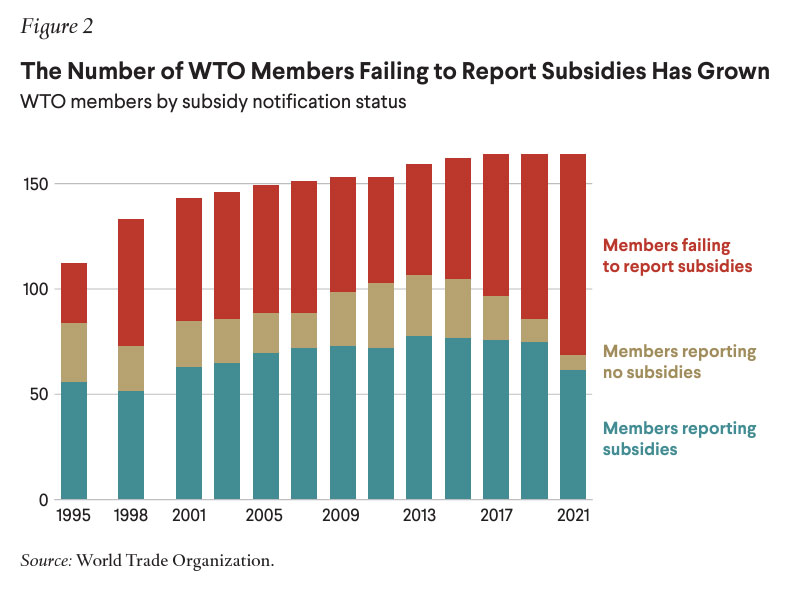

- WTO members are required to provide annual notifications of all specific subsidies granted or maintained but this rule is undermined by tardy reporting by a large and growing number of countries; in addition, members only notify what they believe to be a subsidy, leaving many programs unidentified; the lack of notifications impairs the ability to assess member compliance and limits the breadth of discussions. (pp. 13-14, Figure 2)

- Remedies available under WTO rules are an impediment to the SCM agreement’s ability to police subsidies; the three remedies include for prohibited subsidies withdrawal of the subsidy without delay, and for all other subsidies CVDs or bringing a serious prejudice case to the WTO; CVDs are only available in countries importing the product and with a domestic industry making comparable products; investigations take a long time and require data that is difficult to obtain and CVDs can push subsidized goods into other markets, suppressing prices; in serious prejudice cases remedies are prospective and the elements of proof have temporal aspects; a long time passes before a challenge can be brought and compliance realized. (pp. 14-15)

- WTO rules no longer distinguish between subsidies deserving of discipline and encouraged subsidies as the provision listing non-actionable subsidies has expired; while in some contexts members have discussed listing prohibited subsidies, no progress has been made in adopting a list; defining desirable subsidies and agreeing on whether and how to carve the out of the subsidy disciplines is a tall order. (pp. 15-16)

How to apply the insights

-

This section usefully describes the key details of the WTO rules on subsidies – the SCM Agreement – and concisely illustrates the challenges to each rule and difficulty of regulating subsidies under these rules.

-

This description is helpful for anyone who wishes to understand quickly how WTO rules are meant to work and why they may be insufficient for disciplining subsidies now.

The US challenge to the subsidies regime

- Subsidies have posed a challenge to the international trading system for decades; since 2008, subsidies have been the most frequent form of intervention; the US, EU, and China are responsible for more than half of all subsidy measures, with 37.6% of world trade in goods facing competitive distortions due to these subsidies; 28% of all global goods are touched by EU and US subsidies alone; subsidies are widespread, growing, and often poorly targeted at their policy objectives spurring the use of unilateral defensive measures, eroding public support for open trade and contributing to trade tensions; recent and growing US support for subsidies has amplified these concerns. (pp. 17-18)

- The Inflation Reduction Act, Biden’s signature climate action, includes rules that act like local content requirements which are prohibited under WTO subsidy rules, e.g. tax credits that apply only to vehicles assembled in North America or with battery content sourced in the US or with US FTA partners; these requirements are troubling trading partners, especially the EU, whose leaders claim that US spending will drive investment and jobs out of Europe, while protectionism hinders competition and innovation and is detrimental to climate change mitigation. (pp. 18-19)

- The CHIPS and Science Act will spend $52.7 billion in semiconductor manufacturing, R&D, and workforce development; given how much the US lags key chip manufacturers Taiwan, Korea, Japan, and China, catching up will be challenging and expensive; the CHIPS Act includes geographical restrictions on funding, banning recipients from expanding resources in China or other countries of national security concern; CHIPS Act funding may be insufficient given the high spending of competing economies, high costs of constructing fabs, and complexities of the supply chain; these large investments and lack of international coordination could lead to a glut of supply, fail to correct market failures, and create unnecessary trade conflicts. (pp. 20-22)

Recommendations

- To address concerns with and opportunities created by subsidies, the US should pursue substantive reforms to the current regime, with the goal of retooling or rewriting existing measures in order to provide more flexibility to pursue legitimate objectives through subsidies and to more effectively rein in trade-distorting abuse of the system. (pp. 23-24)

- Limit and distinguish harmful subsidies by adopting the WTO Agreement on Agriculture model of labelling subsidies as “trade-distorting” (amber box), “minimally trade-distorting” (green box) and “production-limiting programs” (blue box) with limits imposed on amber box subsidies and all countries allowed to participate in some level of subsidies by establishing de minimis levels of support; countries should 1) launch negotiations immediately under the WTO or OECD to cap total spending on industrial subsidies; 2) agree to sub-limits within the cap in product sectors and supply-chain points with concentrations in subsidies; 3) identify a narrowly defined category of green-box subsidies without limits; 4) agree on a list of blue-box subsidies excluded from the overall cap because their contribution to the global good outweighs trade-distorting effects; developing the list of green and blue-box subsidies will be one of the most difficult and important elements of new subsidy disciplines. (pp. 24-25)

- Encourage countries to reveal their subsidies by reforming the subsidy notification process to 1) develop clear guidance on exactly what should be notified as a subsidy; 2) prohibit challenges to green or blue box subsidies for at least one year; 3) add penalties for failure to provide timely subsidy notifications; 4) treat non-notified subsidies as actionable and subject to immediate challenges unless proven unharmful; 5) incorporate independent information gathered by the WTO secretariat or other members to fill gaps in missing notifications. (pp. 25-27)

- Increase penalties for rules violations by 1) adopting a speedier process for remedying subsidy rule violations, including by allowing more immediate demands for compensation or the quick imposition of retaliatory measures; and 2) increasing penalties for granting prohibited subsidies, including by requiring recipients of the subsidy to pay back the entire amount of the subsidy, a form of retroactive remedy. (pp. 27-28)

- Now is the time to better use the WTO’s rules and tools, and to update the WTO’s toolbox; as the US is now a key player both in complaining about China’s use of massive subsidies and adoption of its own subsidies, the US should lead the effort to reshape the global rules to better serves its own interests and the international trading system’s changing realities. (pp. 29-30)

How to apply the insights

-

This section provides helpful, thoughtful and specific ideas for reforming subsidy rules using precedent directly from existing WTO agreements and is therefore a practical guide for policymakers and negotiators to follow in working toward subsidy rule reform.

Conclusion

The Rethinking international rules on subsidies report comes at a time when the danger and potential of subsidies are under scrutiny daily. It is more important now than ever for WTO members to apply their expertise in the international trading system to reform, retool, and rework the rules in order to better discipline subsidies. Taking action on this issue could help to ease trade tensions at a time when the international trading system is under intense strain.

Complementary reports and analysis

Hinrich Foundation

- How states use subsidies to impede trade

- Disciplining China’s state capitalism through international trade rules: Regaining the missed opportunity

- CHIPS Act: "Winning the 21st century" or wasteful industrial policy?

External Resources

-

Modern industrial policy and the WTO – Peterson Institute for International Economics

A report raising questions about the use of modern forms of industrial policy and WTO rules. -

New Industrial Policy Observatory – Global Trade Alert

A database of "new industrial policy" measures undertaken since January 2023. -

Industrial policy detectives: China’s subsidies for shipbuilding – Trade Talks (Podcast)

Chinese is estimated to have spent $90 billion on subsidies to create a domestic shipbuilding industry. -

The New Industrial Policy and Its Critics – Project Syndicate

New US industrial policy can be market correcting rather than market distorting.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).