How to use it

USMCA Forward 2022: Building a more competitive, inclusive, and sustainable North American economy

Published 27 September 2022

With the introduction of the United States-Mexico-Canada Agreement (USMCA) in 2020, the North American trade relationship enters a new phase, with renewed possibilities for deeper integration. The Brookings Institution Global & Economy Development Program (Brookings) produced the USMCA Forward 2022 report to promote the USMCA’s long-term success. The report discusses Canadian, US, and Mexican perspectives on competitiveness, supply chains, and the digital economy.

Here’s how to use the report entitled USMCA Forward 2022: Building a more competitive, inclusive, and sustainable North American economy.

Why the report matters

The USMCA represents a renewal of the North American Free Trade Agreement (NAFTA). To this day, Canada and Mexico remain the largest trading partners of the United States by far, largely due to the integration brought about by NAFTA and now the USMCA.

Yet, in all its member countries, NAFTA was an unpopular and much maligned agreement, blamed for manufacturing job loss in the United States, among other ills, across North America. Despite the economic advantages and opportunities conferred by these agreements, the future of North American economic integration remains tenuous. Reports, such as Brookings’ USMCA Forward 2022 help to bring understanding to the context of the agreement, the possibilities it presents, and what USMCA members can accomplish through the agreement.

The report also reminds us that the USMCA is meant to be “a living agreement” in that it is structured to allow ongoing enforcement work and coordination among member states to fulfill the intent of the agreement as economic conditions change and new products and technologies are invented and traded. Yet, without public attention and support, government focus on this important work can wither. The USMCA Forward 2022 report and Brookings’s study of the agreement into the future should help to maintain focus on the agreement and how it can help further open economic possibilities.

What’s in the report

The report contains five chapters:

- A truly competitive North America, which, through the lens of the health care sector, analyzes the role of governments, academia, researchers, and private actors in creating a more competitive region.

- Mexico’s evolving role in global supply chains, which considers the risks of extended supply chains and how Mexico can play a key role in creating more resilient supply chains for North American businesses.

- The USMCA and digital trade in North America, which considers the digital trade relationship among the USMCA partners, and the digital trade issues the USMCA partners should seek to address under the agreement going forward.

- NAFTA-USMCA and wages in Mexico, which addresses how the trade agreements have affected wages in Mexico specifically, and Mexican labor regulations more generally.

- Using the USMCA for climate action, which comments on the lack of specific provisions addressing climate change, while analyzing the provisions that can be used to fight it.

How to find the insights

These five chapters are interspersed with viewpoint essays from current and former high-level government officials, union leaders, and analysts, including one essay from each of the trade ministers of Canada, Mexico, and the United States presenting their respective perspectives on the importance of the USMCA and the North American trade relationship.

Increasing North American competitiveness | Building more resilient supply chains | Expanding digital trade | Strengthening labor standards | Cooperating on climate change and clean technologies

Increasing North American competitiveness

- Future economic success will depend on deeper regional integration, requiring not only effective implementation and a commitment from federal governments, but also the commitment of the larger North American community. (p. 23)

- Further economic integration will be contingent on the regulatory environment and technological advancement in North America; economic value creation is dependent on the complexity of production processes and the number of linkages between economic sectors. (p. 23)

- The key is to use North America’s advantages to deepen competitiveness by improving conditions for innovation in a decentralized way; North America’s richness and flexibility are the main advantage over China’s centralized and rigid system. (p. 24)

- Because of the pandemic, there is a conscious effort by policymakers to ensure sourcing diversification in the health sector and to leverage its potential for strengthening competitiveness. (p. 25)

- Mexico is a reliable supplier of essential healthcare products to the United States; over the past 20 years, Mexico has increased its market share of healthcare exports to the US by 10%. (Graphs 4 and 5, p. 25) Mexico has the potential to grow into this role even more, but needs to develop competitive production of key inputs and increase investments in R&D.

Building more resilient supply chains

- The pandemic, US-China trade war, and adverse environmental events, among others, have made clear the risks of extended global supply chains, and the need to build resilience into supply chains. (p. 38-39)

- The trade agreements among Mexico, Canada, and the US, established under NAFTA and modified and enhanced by USMCA, provide strong incentives for integrated North American production compared to no agreement. USMCA modestly strengthens incentives for Mexico’s involvement in supply chains. (p. 39)

- While there are good arguments for Mexico to strengthen its role in supply chains, there are also serious questions about whether Mexico has adopted the best policies for encouraging manufacturing and investment compared to China and other Asian economies. (p. 40)

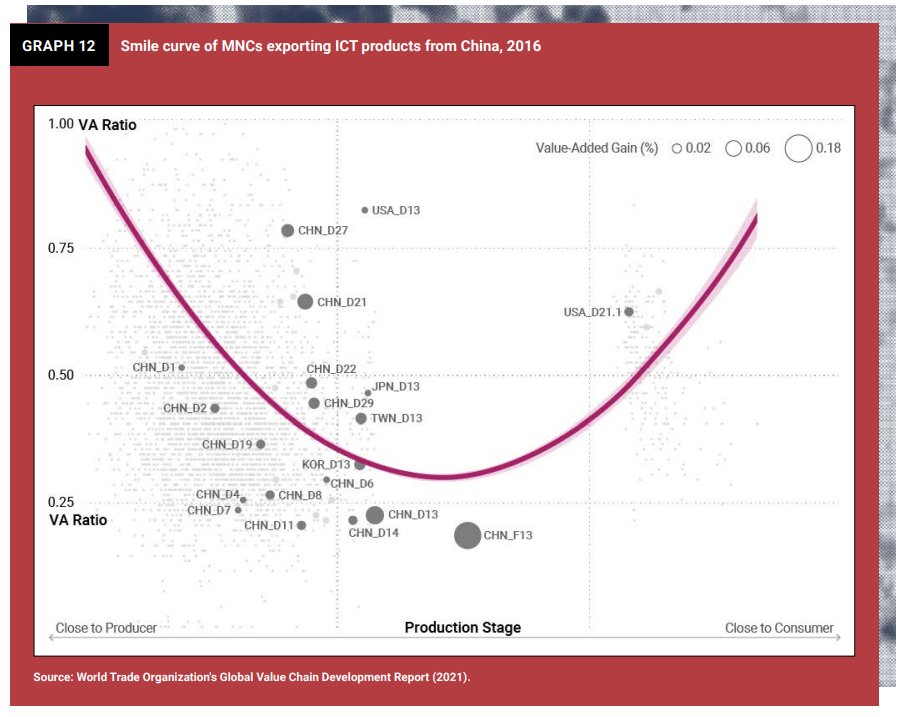

- Using the information and communication technologies (ICT) sector as an example, both China and Mexico are significant exporters but have similar extended supply chains that rely heavily on inputs from Chinese and East Asian suppliers, meaning if more exports were sourced from Mexico, those exports would still rely heavily on Asian and especially Chinese supply chains (due to the scale of Asian manufacturing output). (Graphs 12-14, pp. 41-43)

Expanding digital trade

- Digitally ordered goods and services between the US, Canada, and Mexico could be worth as much as US$250 billion. (p. 51)

- The USMCA contains one of the most ambitious digital trade chapters of any trade agreement, including in liberalizing trade. It prohibits customs duties on digital transactions, restrictions on cross-border data transfers, data localization requirements, and requiring access to source code as a condition of selling in a member state’s territory. (p. 50 and 53)

- USMCA also facilitates digital trade by recognizing electronic signatures; requiring consumer protection laws and non-discriminatory laws protecting personal data; supporting digital competition among internet providers and applications; committing the parties to making government information digitally accessible; and calling for adoption of measures to prevent and respond to cybersecurity threats. (p. 54)

- USMCA asks members to cooperate, coordinate, and share information to achieve these goals; as well as to formalize cooperation by establishing a forum for this work.

- Creating a permanent forum should be a top priority. (p. 54)

- A key focus also should be to develop an integrated, fast, secure, reliable, and inclusive digital infrastructure throughout North America. (p. 54)

- Another area of focus should be to reduce payment-related costs for digital transactions across borders, especially for SMEs. (p. 56)

- A fourth focus area is to ensure trustworthy and reliable free flows of data across borders by coordinating to develop common, high-quality privacy protection standards and regulations. (p. 56)

- Focus should also be on coordinating digital platform regulations to ensure consistency with USMCA standards. (p. 58)

- Lastly, member states should coordinate on new digital technologies like artificial intelligence, blockchain, and quantum computing, to avoid protectionist actions and duplicating efforts. (p. 58)

Strengthening labor standards

- In spite of NAFTA, average wages in Mexico did not increase from pre-NAFTA levels, though in the absence of NAFTA, wages would have been marginally lower. (p. 63) NAFTA had a small positive effect on urban wages in Mexico, but not sufficiently powerful to offset the forces that keep wages low (pp. 68-70)

- It is unlikely that USMCA will lead to higher wages in Mexico as long as Mexico’s current domestic regulations are in place. (p. 63)

- Although USMCA pushed for reforms to Mexico’s labor law, including allowing salaried workers to elect unions to represent them and a mechanism for US and Canadian firms to request investigations into non-compliance, these reforms did not change the underlying labor and social insurance architecture. (p. 70)

- If USMCA increases labor costs in relevant economic areas, aggregate productivity in Mexico may suffer. (p. 63)

- Average wages in Mexico will increase when the productivity of all of the Mexican economy increases, not only the relatively small USMCA-related segment. (p. 72)

Cooperating on climate change and clean technologies

- Chapter 24 requires effective enforcement of environmental laws and environmental impact assessments of proposed projects; makes seven multilateral environmental agreements enforceable through USMCA dispute settlement; and includes provisions to protect biodiversity, wildlife, and sustainability. (p. 79)

- Chapter 24 also calls for facilitating and promoting trade in environmental goods and services; members can build on that provision to reduce or eliminate tariffs on such goods among themselves and through multilateral agreements. (p. 81)

- Working under Chapter 11’s call for mechanisms to support greater regulatory alignment, members can align standards and regulations to limit carbon emissions and improve manufacturing efficiency. (p. 81)

- Annex 12-D seeks cooperation on energy performance standards, which could be an avenue towards building greater energy efficiency across the region. (p. 81)

- Efforts in Mexico to rollback progress on energy efficiency and reemphasize the primacy of fossil fuels could hamper these efforts. (pp. 81-82)

- USMCA members also have opportunities to coordinate and cooperate in their approach to climate-related trade restrictions, like tariffs on products associated with high emissions.

Conclusion

Brookings’ USMCA Forward 2022 report explores the USMCA and its role in the North American economic relationship through the lens of five current “hot topics” in trade, including climate change, digital trade, and supply chain resiliency. The report also contains several viewpoints from those with unique insights into the agreement and how it functions. In doing so, the report highlights the usefulness and importance of the USMCA to its three members, the opportunities it presents, as well as its limitations. By providing this analysis, the Brookings Institute helpfully sheds light on the importance of the USMCA and its predecessor in building a highly integrated and successful regional economic bloc, and North America’s potential for even greater integration.

***

Complementary reports and analysis

Hinrich Foundation

- Are climate policies and trade policies on a collision course?

- Data governance and trade: The Asia-Pacific leads the way

- "New NAFTA" debates signal importance – and challenges – of sustainable trade

External Resources

- USMCA at 2: Visions for next steps – Brookings Institution

A follow on report commemorating USMCA’s second anniversary, with essays expressing aspirations and warnings for the future of the agreement. - Digital Trade and U.S. Trade Policy – Congressional Research Service

This report discusses the role of digital trade in the U.S. economy, barriers to digital trade, digital trade agreement provisions and negotiations, and other selected policy issues. - Can Mexico help bring supply chains back to North America? – Peterson Institute for International Economics

The blog assesses the viability of Mexico as a natural choice for "nearshoring" investment closer to the US.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).