Sustainable trade

The pandemic disrupted global supply chains but were they already morphing?

Published 21 May 2020 | 6 minute read

COVID-19 is disrupting the operation of global supply chains, causing many businesses (and countries) to rethink where they source their products. Is the pandemic accelerating trends already underway?

Were trade policies – both liberalizing and protectionist – inducing some degree of “nearshoring” to avoid tariffs or to focus on regional trade made easier and less costly through free trade agreements?

In the case of the United States at least, the answer may be yes.

How global supply chains stretched

Supply chains encompass all the people, technology and resources that go into producing a final product or service. Supply “chain” is an oversimplified term as they are not linear; they are more like interconnected networks.

Historically, supply chains were extremely short – you, or maybe your village, were the entire chain. As economies grew more complex, so did supply chains, enabling more firms to specialize. Companies are now able to source from a wide variety of suppliers to reduce costs and improve efficiency.

Advances in communication technologies and transportation made it both inexpensive for products to cross national borders multiple times and easier to coordinate complex activities at a distance. Resources, labor and technological expertise in multiple countries are leveraged as value is added throughout global supply chains. International production strengthened many companies’ competitiveness. Many multinational companies also invested in production overseas as part of their supply chain strategies.

Stretched and strained

As supply chains stretched, imports became increasingly important in the U.S. American manufacturers rely heavily on imports for the inputs into their American-made goods whether those goods are consumed domestically or ultimately exported.

For many years China has been the go-to for much of this intermediary production, with companies attracted to its large supply of low-wage workers and China’s specialization in certain manufacturing. The concentration of manufacturing in China has led to mounting concern over whether China is competing unfairly through subsidization, market access restrictions, technology transfer and localization requirements. These and other policies have attracted more manufacturing to China and away from both advanced economies like the United States and other low-cost producers in Asia, a trend that may be now reversing.

The COVID-19 pandemic brought this concern into sharp relief, sparking policy discussions over whether U.S. innovators and producers have become over-reliant on China for resources, inputs and final production. But even before the pandemic, the subtext of the U.S.-China trade war was U.S. pressure on companies to reexamine and “rebalance” the structure of their supply and production networks as incentivized by mounting tariffs.

And even before the tariff war heated up, businesses were seeking ways to shorten their global supply chains to reduce their vulnerability to external disruptions such as changes to trade rules, natural disasters, or other crises, according to a 2017 report by The Economist Intelligence Unit and Standard Chartered.

Has global value chain participation peaked?

So now that COVID-19 has caused severe disruption to supply chains, the question on everyone’s minds is: will it cause a retreat in participation in global value chains? Or, was participation in global value chains already peaking before the pandemic and if so, will the pandemic hasten the decline?

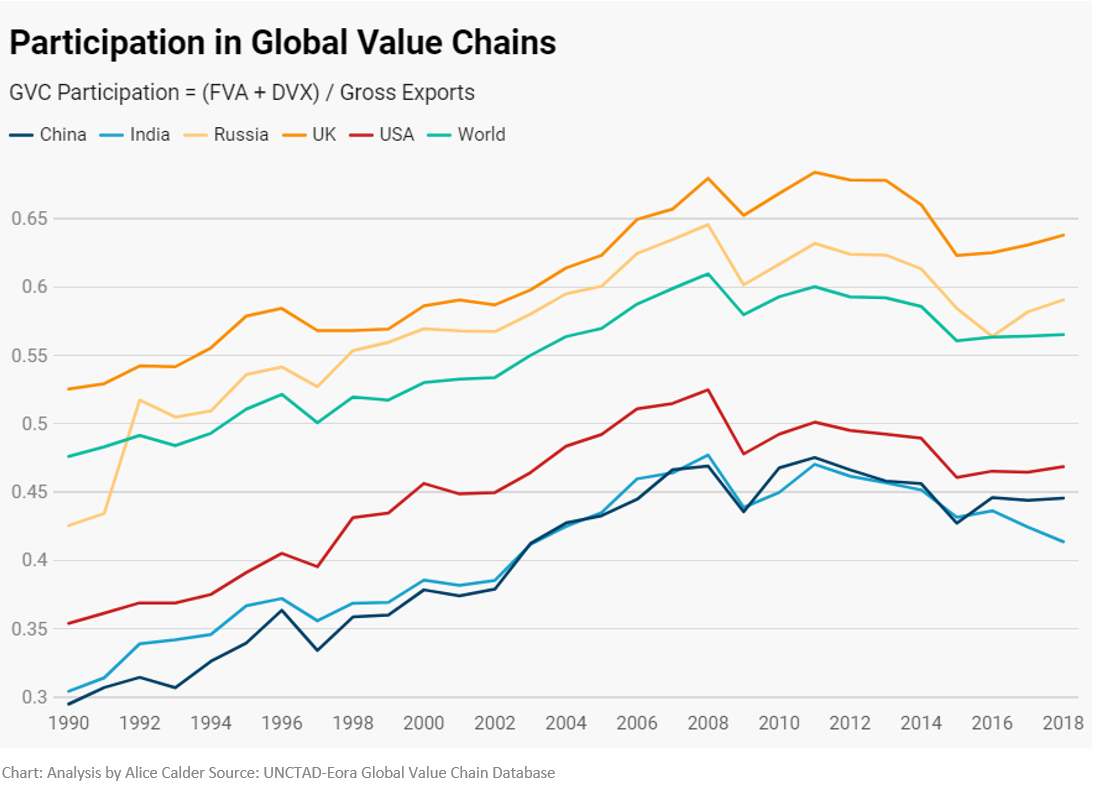

We can calculate trends in global value chain (GVC) participation using the UNCTAD-Eora Global Value Chain (GVC) Database. Though supply chains and value chains are not exactly analogous, both show the spread of supply networks across countries. A country’s global value chain participation index can be calculated by summing the foreign value added (FVA) and the indirect value added (DVX) content of its exports, and dividing this by its gross exports.

The chart below shows participation in GVCs generally flattened out from around 2010-2012 after dipping in 2008. It does not show a retreat from global supply chain involvement (though India shows a slight decline). COVID-19 renders the future trajectory unpredictable.

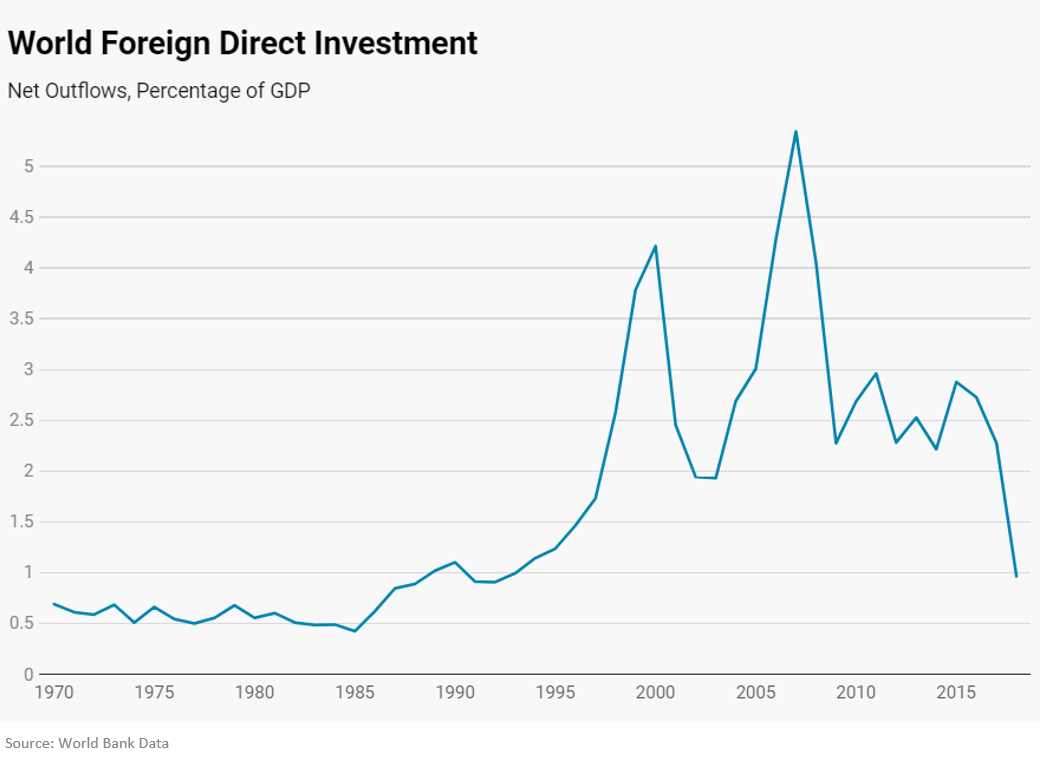

Another measure of trends in global value chains is global foreign direct investment (FDI). In this respect, the trends are far clearer. The data show a significant and sharp decrease in FDI since 2008. This may be a reflection of the decreasing rate of return on FDI, as the initial returns to scale for large multinational corporations start to diminish and new local competitors come online.

The expansion of the digital economy is also likely a big factor in shifts away from FDI commitments, as improvements and diffusion of technology allows businesses to provide services without foreign direct investment in a location. A reduction in FDI may therefore show a complete removal of international involvement, or may just represent a shift in the distance and nature of involvement and investments in foreign markets.

Diversification and regionalization, not de-globalization

The expansion of global value chains does appear to have slowed from the heady pre-recession era, and direct on-the-ground investment has plummeted. But, just as with globalization in general, it is too early to say whether supply chains as a whole are shrinking, shifting or something else. Companies could be mitigating risk by diversifying supplier relationships and regionalizing supply chains in response to a proliferation of regional trade agreements that removed barriers.

Looking at the United States specifically, there is evidence of both shifts.

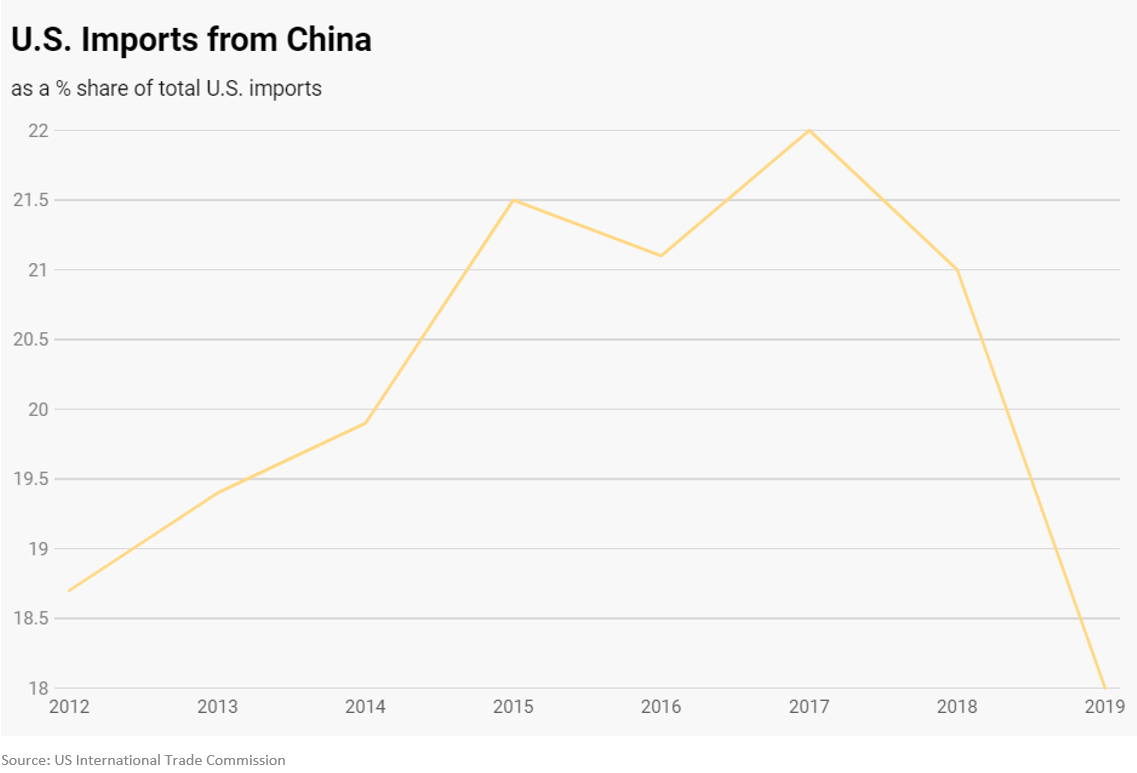

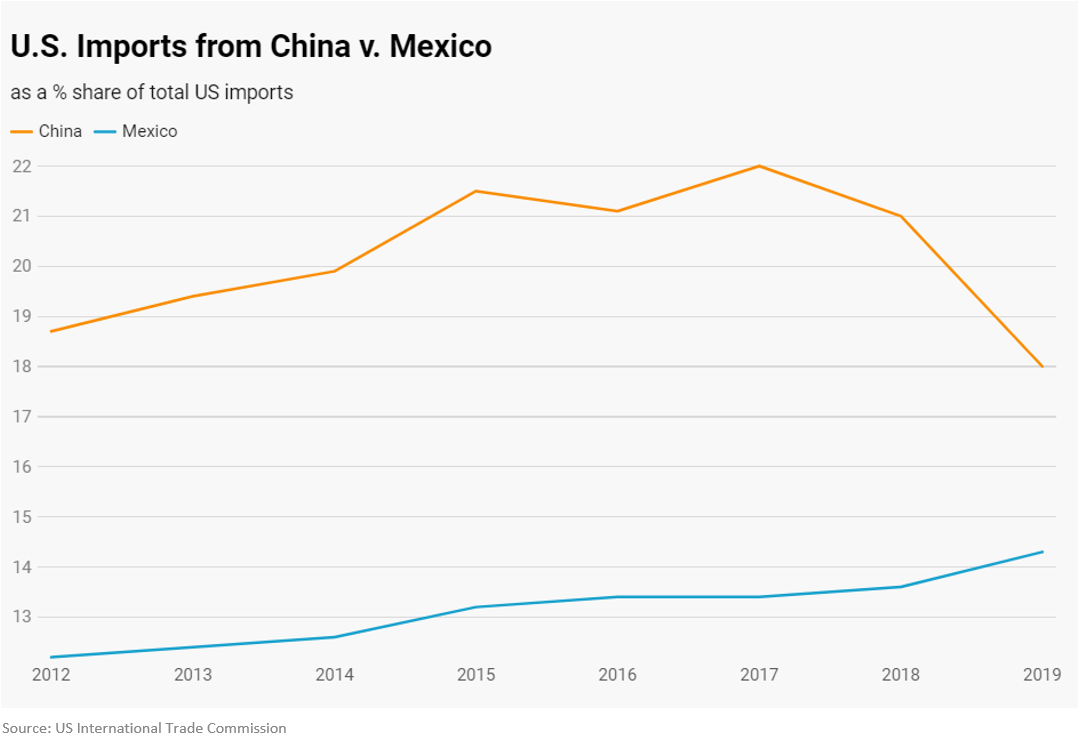

As seen in the chart below, the share of total U.S. imports from China have sharply declined. As we might expect, 2017 marks the beginning of a downturn in the share of imports coming from China. The particularly sharp drop after 2018 shows the effects of the U.S.-China trade war, reflecting the increased costs imposed by tariffs. The sustained political risk combined with trade policies prompted businesses to reduce reliance on exports from China in favor of sourcing elsewhere in the world.

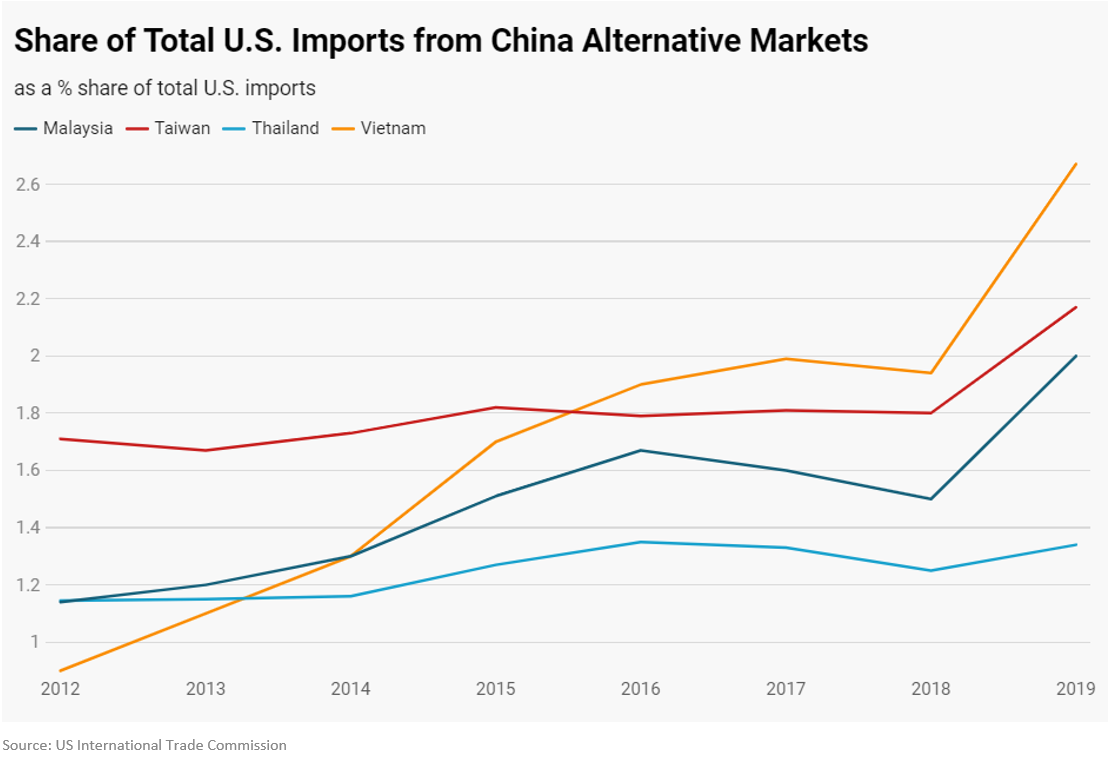

Over the same time period, low-cost Asian producers such as Thailand and Vietnam saw an uptick in share of U.S. imports. U.S. companies may be diversifying production relationships away from China and toward other countries in the region, or at least taking advantage of excess production capacity in facilities elsewhere. The increases are significant but not massive in real monetary terms for a single country, suggesting a “don’t put all your eggs in one basket” mentality.

Even the United States’ largest tech companies like Apple, Microsoft and Google have been reportedly exploring similar moves. In their recent re-shoring report, Kearney found evidence that low-cost producers in Asia have been the beneficiaries over the last five years of efforts from U.S. companies to diversify their supplier networks.

There is also evidence that companies are doubling down on natural geographic trading partners through regionalization of supply networks. Mexico’s share of U.S. imports has increased steadily over the last few years, with a particularly sharp increase in 2019 in tandem with the U.S.-China tariff war.

Regional economic integration is not a new policy strategy. Many of the earliest free trade agreements were regional in nature. Under NAFTA, U.S. firms leveraged the complementary assets of our neighbors to the north and south to strengthen the global competitiveness of regionally-made products. As the Bush Institute Global Competitiveness Scorecard shows, the United States, Canada and Mexico are more competitive as a North American region than any other region in the world. The implementation of the U.S.-Mexico-Canada Agreement will provide incentive to reinforce these relationships as U.S. companies think about “rebalancing” their supply networks.

What to look for

It is still too early to see the real effects of the COVID-19 pandemic or even the US-China trade war in the data on imports and global value chains, predictions notwithstanding.

Global value chains may be expected to remain complex, but could shift to cross borders that are closer geographically as trade increases among regional partners within Europe, North America and Pacific Rim countries. A key indicator for this will be changes in shipping trends. Expert Martin Stopford predicts a decrease in demand for large container ships and an uptick in demand for smaller shipping vessels that are more economical for shorter routes.

Before the pandemic, global supply chain expansion was not increasing at the speed it once was, but reports of its demise are premature. Instead, companies are thinking about diversification for improved resilience without sacrificing the benefits of a global and interconnected system of international trade.

Meanwhile, hopes for American reshoring may be equally overblown. The United States has obstacles to overcome, including a shortage of skilled labor and high production costs. Nonetheless, companies will have to assess whether a cost-above-all-else approach to manufacturing and sourcing is sustainable in a post-pandemic global economy.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).