Published 28 September 2018

Until recently, the gains from commercial use of space manifested primarily in the growing use of satellites that enable precise navigational maps in your car and the dish on your roof to channel satellite television into your home. A new era is dawning in which private companies routinely launch payloads into space.

From Sputnik to SpaceX

The first era of the race to space revolved around the dramatic contest between the United States and Soviet governments, ignited by the Soviet launch of Sputnik in 1957. Forays into space over subsequent decades remained the domain of nation states.

Private companies were commissioned by government agencies to deliver critical components, propulsion technologies, an array of instruments, mechanisms, robotics, electronics, and sensors, but companies did not perform launch or transportation services until the 1980s when the European Space Agency created Arianespace, the world’s first commercial space transportation company. The United States began to deregulate in the 1990s. With the collapse of the Soviet Union during the same period, Russian technologies made their way into a burgeoning global commercial market.

Until recently, the gains from commercial use of space manifested primarily in the growing use of satellites that enable precise navigational maps in your car and the dish on your roof to channel satellite television into your home. Satellite imagery and sensors are now used to help farmers monitor soil, weather conditions, and crop development; indicate the optimal placement of solar panels to harness energy; monitor reserves of natural resources; or track mass movements of refugees for the delivery of aid. These are a few examples of how commercial use of space spawns an array of new goods and services that can be utilized and traded internationally.

Faster, better, cheaper?

A new era is dawning in which private companies routinely launch payloads into space. NASA is no longer funded to meet its own launch needs so it provides contracts to private companies such as SpaceX and Orbital ATK (now owned by Northrup Grumman), guaranteeing them a market for a certain number of launches to ferry its cargo into space. NASA’s investments and the ability to lease NASA space launch sites enable these companies to experiment, test, and innovate ways to reduce costs and improve reliability.

The ability of commercial launch providers to bring down the cost of placing both private and government satellites into low Earth orbit and geosynchronous Earth orbit has fueled growth in commercial satellite manufacturing. As greater capability is built into smaller satellites, the ability to purchase and launch satellites becomes more accessible to a broader array of companies around the world. Already today, companies can have a US$100 million rocket built to their specifications just by ordering online at rocketbuilder.com.

SpaceX achieved the first successful return of a spacecraft from low-earth orbit. Reuse not only provides cost savings. The ability to bring cargo back and not have it burn upon re-entry opens the door to develop commercial space mining. American companies like Deep Space Industries in Mountain View, CA and Planetary Resources in Redmond, WA have developed probes for searching asteroids for materials to bring back to Earth. Given recent concerns over China preventing the export of rare earths critical to a slew of high-tech industries, the race to retrieve precious metals and minerals from space takes on critical and urgent dimensions.

We are not alone

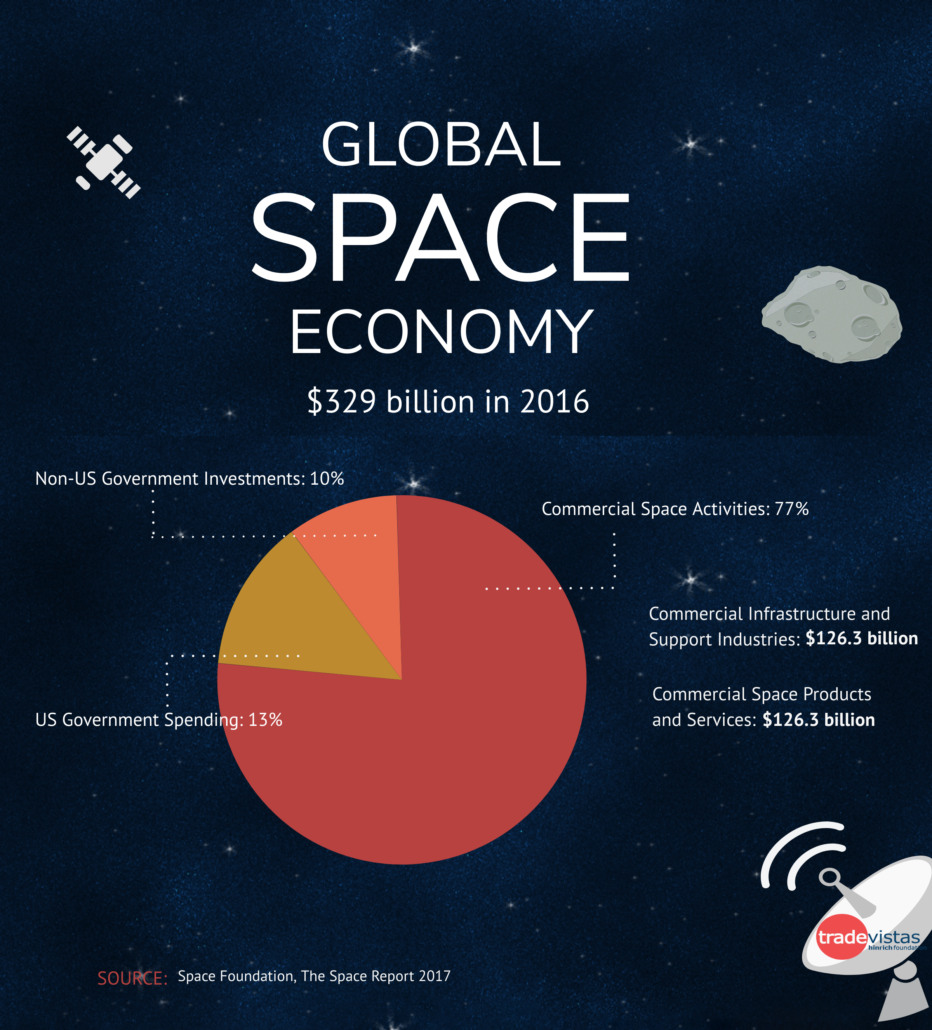

The global space economy was estimated to be worth nearly US$329 billion in 2016. The Federal Aviation Administration produced a report in 2009 estimating that commercial space transportation and related activities generated well over US$200 billion in economic activity just in the United States.

There are over 800 operational American satellites and more than 1,500 total orbiting around Earth, but with orders rising exponentially, the space population of satellites will likely top 15,000 by 2024. The increase in space activity has a dark side, generating over 600,000 items of space debris. The Department of Defense tracks and collects data on debris to protect its own assets, but it has also been playing space traffic cop, alerting companies like DirectTV when debris is headed for their satellites.

Although only a handful of major companies, mostly American or European, have the capability to build large scale commercial satellite platforms, there’s dynamism in manufacturing of smaller satellite platforms – “cubesats” and nanosatellites — that are more cost effective. While many of the players in this growing segment are American and European, there are scores of companies representing more countries including India, Japan, Brazil, Russia, and China.

Final frontier of trade policy?

President Trump has issued three Space Policy Directives thus far aimed at streamlining licensing for launch and re-entry, facilitating public dissemination of Defense Department data on space objects to help avoid collisions, and creating a focal point for the space industry within the Department of Commerce: the Space Policy Advancing Commercial Enterprise (SPACE) Administration. According to Commerce Secretary Wilbur Ross, the SPACE Administration will provide not just industry oversight, but offer “insights and foresight” to foster the expansion of a leading edge commercial space industry.

Meanwhile, the industry remains constrained by uncertainty around the laws and regulations that govern their activities both on terra firma and in space. Nation states control the airspace that extends vertically over their sovereign territory, but once you get into outer space, the laws and norms are murkier.

Government oversight:

A 1967 international treaty, known simply as the “Outer Space Treaty,” enumerates principles that apply to operations conducted by government agencies, but signatories also agree their governments are responsible to authorize and supervise national activities conducted in outer space by non-governmental entities.

Property rights and liability:

According to the Outer Space Treaty, nation states retain jurisdiction over their space objects and personnel in space, and shall be liable for damage caused by their space objects. But the treaty does not clearly cover private commercial property rights. With hundreds of thousands of trackable pieces of space debris already in orbit, the prospect of inadvertent damage to spacecraft and satellites is a mounting concern. But who’s responsible and how can you know the origin of most debris? What entity might be appropriate to settle disputes over orbital assignments? Once competition is sparked among companies in space mining, what set of national or international laws will apply to territorial claims staked and subsequent international sales among commercial parties of materials mined in space?

Trade in space-related technologies and services:

US law does clarify that the launch or re-entry of a space launch vehicle or payload is not deemed an export or an import (perhaps at least until we find aliens on other planets with whom to trade). However, all spacecraft and nearly all critical components of spacecraft, ground equipment, and related space technologies are classified as “defense articles” on the U.S. Munitions List. As such, they are restricted or prohibited under the International Traffic in Arms Regulations administered by the State Department from being traded or transferred to another country – or to a person from another country, even if that transaction takes place within the United States.

These restrictions also apply to the exchange of services such as engineering or consulting, including emails and conversations on related technical subjects. Some technologies have been moved a less restrictive Commercial Control List maintained by the Department of Commerce that applies to dual-use technologies, or those that have both military and commercial applications. Nonetheless, these regulatory frameworks for better or worse constrain the integration of a global space industry.

Sanctions:

US sanctions also figure into commercial space trade given Russia’s predominant role as a supplier of launch services and space technologies as well as involvement in the Russian space industry of individuals who are the subject of US sanctions.

Tariffs:

The WTO Information Technology Agreement (ITA) as expanded in 2015 will eliminate tariffs among the parties on many goods and technologies deployed in space activities. The savings should benefit commercial entities that are expanding production of the systems and equipment needed for extraterrestrial exploration and transportation, as well as the goods and services back here on Earth derived from the innovations in the space industry or the data retrieved from satellites.

Space commerce: Live long and prosper

Maybe one day we’ll be negotiating trade deals with other planets, but for now, we’re a long way off from having the framework we might need here on Earth if the space industry grows at the current pace.

Pioneering commercial uses of space can be a major growth driver for the US economy in addition to being critical to national security, offering important redundancies in capabilities, resiliency, and innovation. What we learn from outer space gives rise to new products and services on Earth. The allure of space as a business is attracting many more companies around the world as we quickly approach the frontier of international commercial disciplines. We’ll need to figure it all out if we want peaceful and sustainable commercial use of space. As Spock might say, may space commerce live long and prosper.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).