Published 16 June 2017

As everything can be found online and purchased, most consumers don’t see difference between the products. But when the product is shipped across the border, the “de minimis” rule is in play.

Big Things Come in Small Packages

Logistics providers say that their biggest challenge – and opportunity – right now is that customer orders are more frequent but smaller. Services like Amazon Prime Now have created an on-demand consumer expectation. Need glue for a school project? Have it on your doorstep in one to two hours with no shipping fee.

Goods are moving in and out of distribution centers faster than ever. Once you place an order, a pack has to be picked, so to speak. To fulfill smaller orders, pallets and cases are broken down to grab the small quantity needed. Trucks must be organized so multiple vendors can share the ride, cutting transport costs. The trend is prompting storage companies to rethink warehouse design and weigh the costs of human labor against automation.

From Toothpaste to Trading Cards

Because most everything can be found online and purchased in small quantities, most consumers don’t see much difference between buying toothpaste from CVS online or purchasing an Alex Galchenyuk hockey trading card from Canada on eBay. But when the product is shipped across an international border, the “de minimis” rule is in play. De minimis in international trade refers to the monetary value below which shipments entering the country are free from duties, taxes, or formal customs procedures.

American consumers have caught a nice break. Through the Trade Facilitation and Trade Enforcement act of 2015, the United States raised the de minimis amount from $200 for commercial goods entering the United States to $800. The change not only lower the costs of international e-commerce (and other) purchases for American consumers, it also helps small businesses source inputs more flexibly for their products without incurring unnecessary costs and dealing with the extra paperwork. Back in 2011, even before the explosion of small purchases, the Peterson Institute estimated cost savings of $17 million annually across the 3.8 million shipments in commerce in the United States at that time.

Chump Change

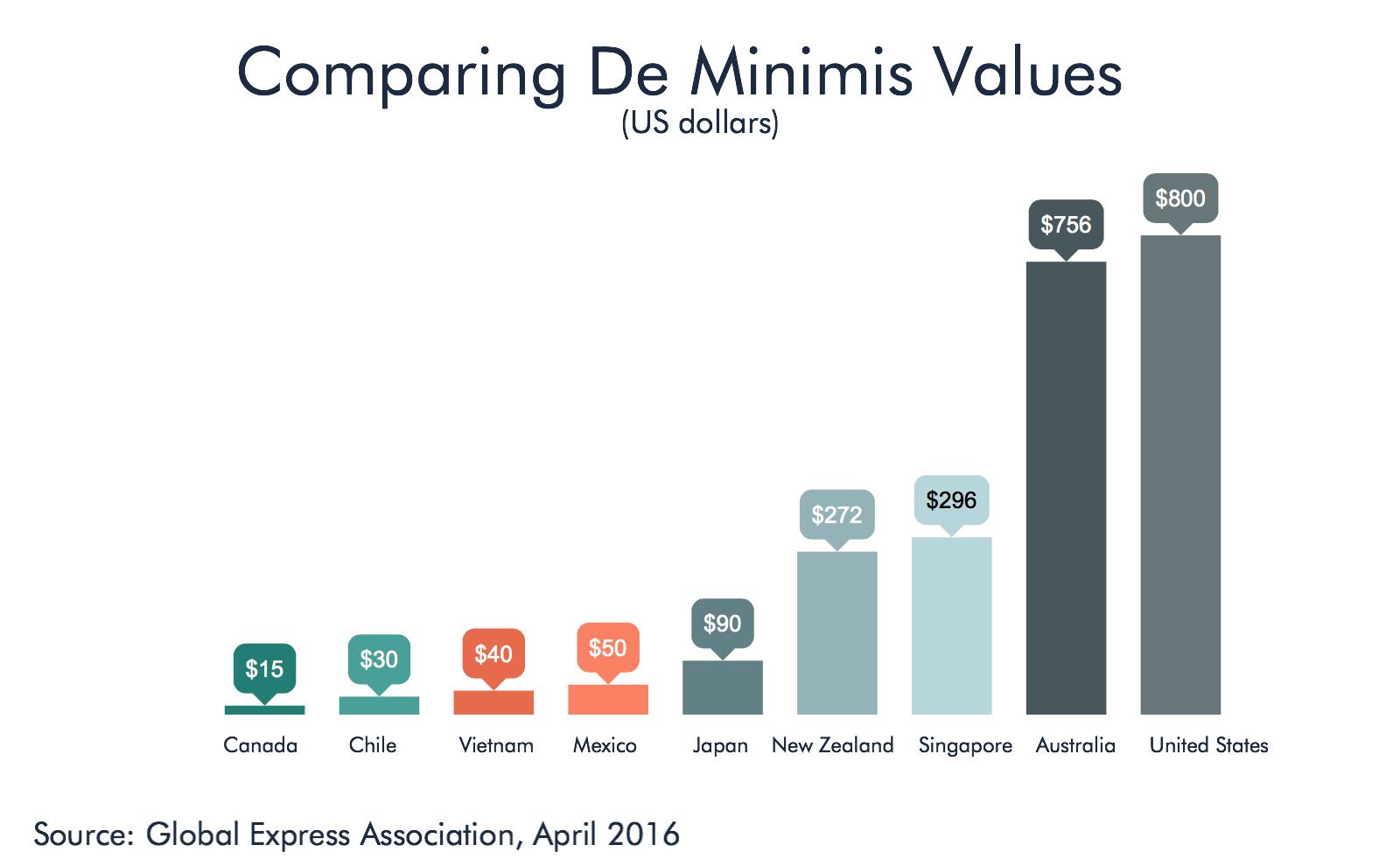

The $800 de minimis threshold in the United States is more generous than most countries, which generally cap duty-free imports at a much lower value. Some governments are so stingy with their de minimis thresholds as to beg the question: why bother.

Government opposition to raising the de minimis threshold usually centers on concerns for the loss of government revenue, but empirical studies such as the one by the Peterson Institute show that the costs imposed on government customs agencies to collect taxes and duties on low-value items outweigh the revenue collected. Why keep the threshold low then? In part, because domestic retailers who are required to charge local sales or value-added taxes think that competing products imported duty-free put them at a disadvantage and they put pressure on governments to not raise the threshold.

NAFTA 2.0 – It’s the Least We Could Do?

Canada sets its de minimis threshold at just $20 Canadian dollars (US$15). In a study commissioned by the C.D. Howe Institute in 2016, economists concluded that increasing the de minimis threshold would be fiscally neutral or positive for the Canadian government, and clearly positive for Canadian consumers and businesses to the tune of somewhere between Canadian $202 million and $648 million.

With Canada’s cap for low-value duty-free shipments far below that of the United States, and Mexico’s at just $50, look for the de minimis threshold to be on the U.S. wish list for NAFTA 2.0.

Trade Policy for the Little Guy

Amazon, Etsy, and eBay all offer digital marketplaces with services to support small and medium-sized businesses advertise and sell their products online. Often these individuals and businesses are selling relatively low-cost goods and services to both domestic and international customers. Some 97 percent of U.S. small and medium-sized businesses selling on eBay are exporters. PayPal is another financial intermediary making cross-border sales accessible to businesses of all sizes.

With smaller sized transactions, administrative costs such as tariffs and customs fees make a big difference. Raising the de minimis threshold opens the door to many more small purchases, which consumers the world over are growing to expect as a fact of life, and which U.S. exporters are more than happy to oblige.

Feature Image Credit: Trading Card Offered on eBay.com

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).