Foreign direct investment

Enabling sustainable investment in ASEAN

Published 07 February 2023

What can ASEAN member states do to further promote investment benefits for their social and environmental objectives? In this report co-sponsored by the Hinrich Foundation, the Organisation for Economic Co-operation and Development (OECD) measures the impact of sustainable FDI in Southeast Asia, reviews the region's investment policy reforms, and suggests ways to enable responsible business conduct and foster green investment.

Southeast Asia has developed rapidly over the past two decades and the region is a major engine of global economic growth. Member states of the Association of Southeast Asian Nations are at very different stages of development, but almost all their economies have more than doubled in size since 2000.

Thanks to strong political commitment to effective policies, over 100 million people in the region have been lifted out of poverty in the last 20 years. Member states have individually and collectively made substantial improvements in the climate for investment. Southeast Asia has been among the biggest recipients of foreign direct investment (FDI) among emerging regions, as some countries in the region were early movers in the shift towards export-led development based in part on FDI.

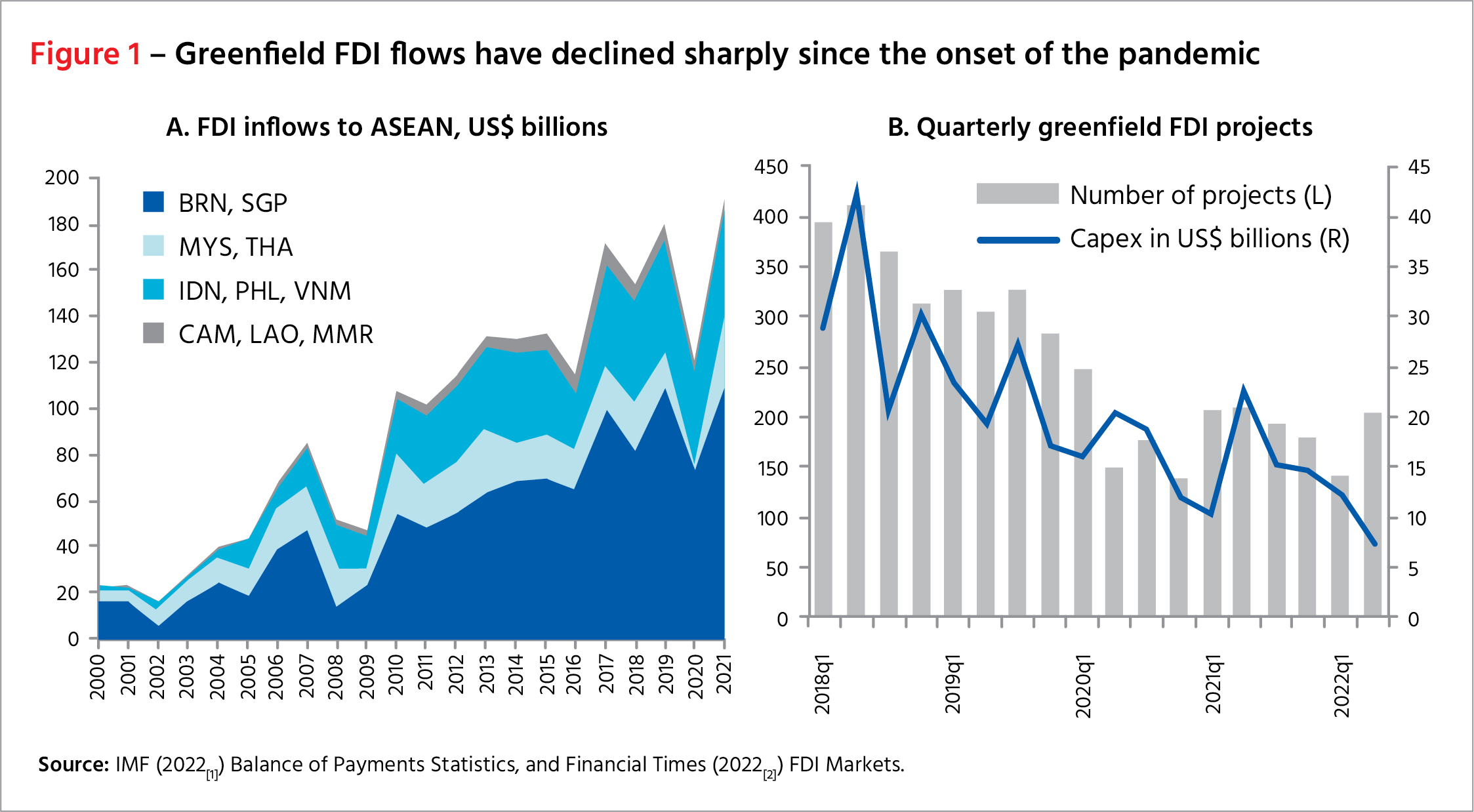

As the below charts show, FDI flows to Southeast Asia have increased by a factor of nine over the last two decades, with over half of these going to Singapore which tends to act as the regional hub for many investors to invest into other AMS.

Nevertheless, new, “greenfield” investment projects have seen a major decline since the onset of the COVID-19 pandemic, with no signs of improvement yet.

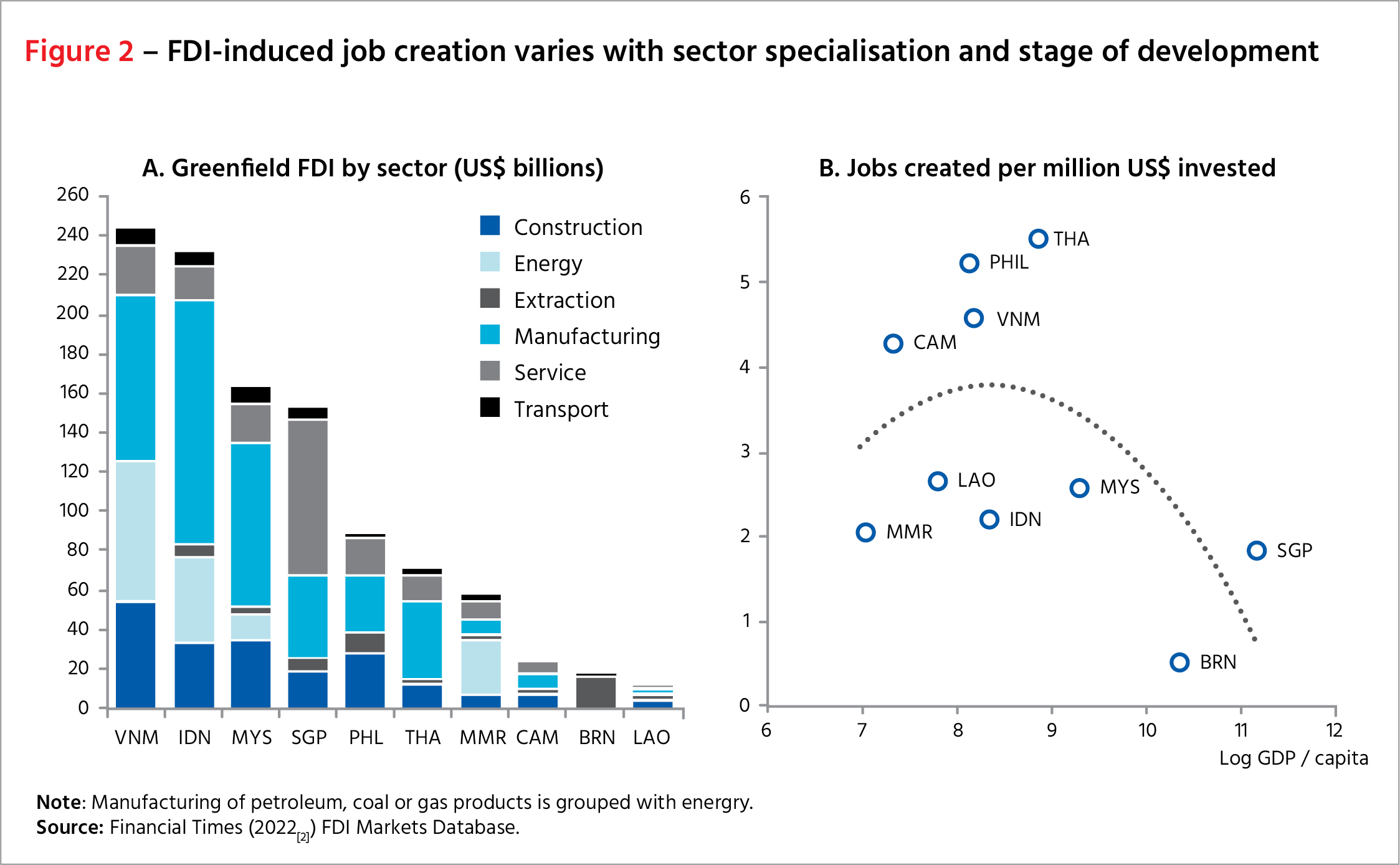

Governments in Southeast Asia devote ample resources to attracting FDI with the hope of creating jobs. Greenfield FDI projects generate on average three direct jobs per million USD invested in the region, but the intensity of job creation varies substantially across countries according to their level of development and economic structure.

Lower-income countries, such as Myanmar and Lao PDR, as well as countries with abundant fossil fuel resources, such as Brunei Darussalam, tend to attract considerable FDI in natural resource extraction and energy generation, which creates relatively few direct jobs. Emerging economies with solid and diversified industrial capabilities, such as Viet Nam and Thailand, create the most jobs per USD invested. Countries with highly skilled labor forces, advanced industries and large financial sectors, such as Malaysia and Singapore, attract FDI in high-tech products and knowledge-intensive services, which require fewer workers.

The high capital intensity of manufacturing FDI in Indonesia is driven by the metals and chemicals industries, while the high labor intensity of FDI in the Philippines is driven primarily by business support services.

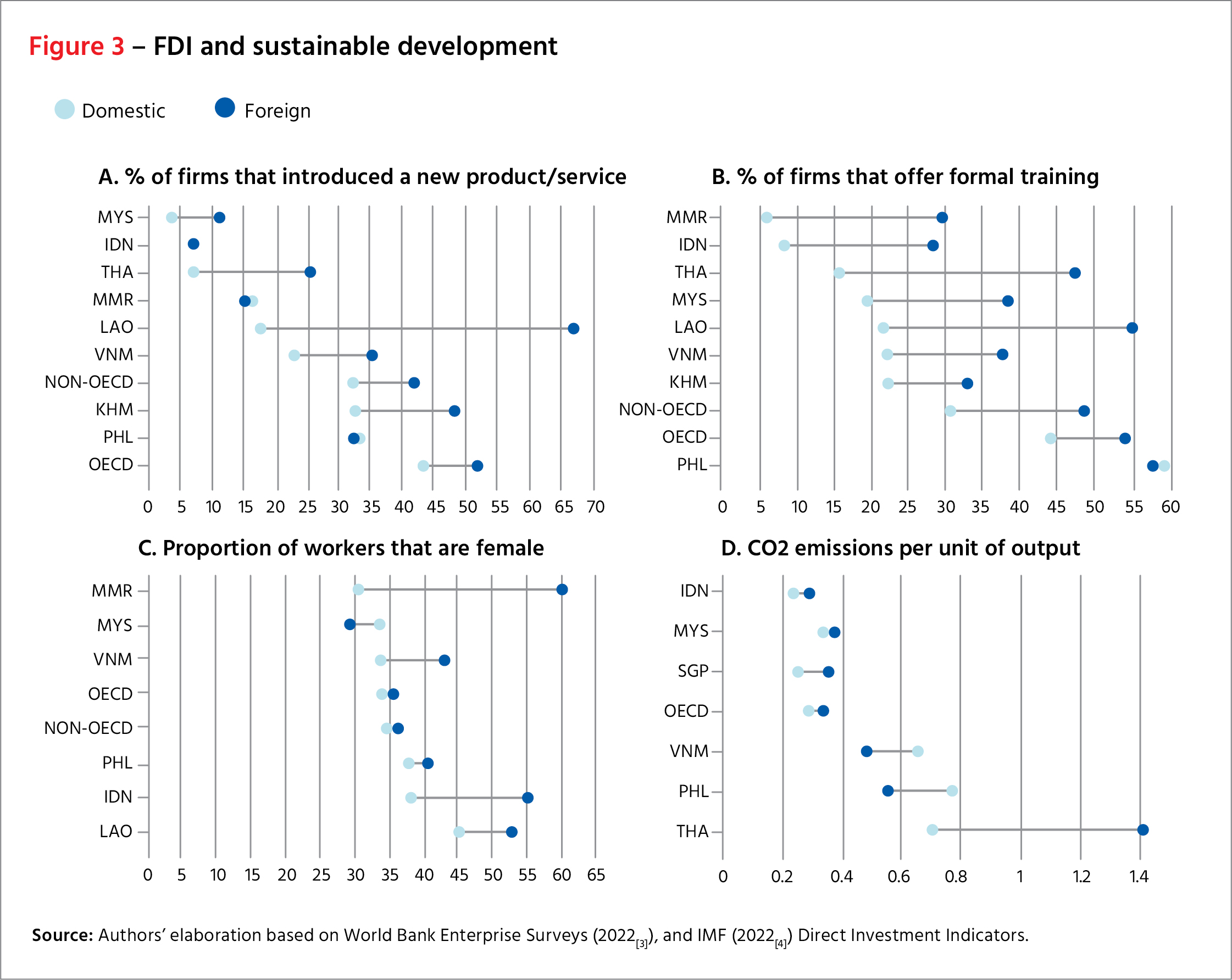

Beyond capital and jobs, FDI has made significant contributions to sustainable development in Southeast Asia. Significantly more foreign firms introduce new products and services than their domestic counterparts across most countries in Southeast Asia, and this greater innovation capacity suggests that there is potential for knowledge and technology to spill over to domestic firms. Foreign firms are also more likely to offer training opportunities to their employees, and the gap between foreign and domestic firms is considerably larger in many member states than in the average OECD or non-OECD country, suggesting that foreign firms contribute disproportionately to on-the-job skills development in the region.

By employing larger shares of women in their workforces in most ASEAN member states, foreign firms can also help improve gender equality in the workplace. Yet, some economies have benefited more than others, and the benefits of FDI have not been felt evenly across different parts of society.

While FDI creates jobs and contributes to upgrading skills and raising living standards, it can also create risks of irresponsible and unsustainable business practices and worsen income inequality, potentially leaving vulnerable segments of the population behind.

The contribution of FDI to green growth and decarbonization is not clear-cut. In Indonesia and Thailand, for example, FDI may be less aligned with national climate goals whereas in Viet Nam and the Philippines, the carbon footprint of FDI is lower than that of domestic investment. FDI’s contribution to renewable energy capacity in Southeast Asia has also lagged behind that of other regions, and varies considerably across the region.

In this in-depth report, co-sponsored by the Hinrich Foundation, a team of OECD analysts review the extent to which sustainable FDI has impacted the Southeast Asian region, how ASEAN member states have sought to court such capital, and uses OECD tools to recommend policy reforms to foster green investment in the region.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).