Published 24 March 2020 | 10 minute read

The oil price war that resulted in a collapse in the price of oil in early March 2020. It presents the US Administration with a policy conundrum.

Much of the US oil industry is unviable at price levels below USD50 per barrel (bbl). At USD30/bbl the majority of US oil production will be loss making. Saudi Arabia and Russia are flooding an already over-supplied oil market under deteriorating demand conditions.

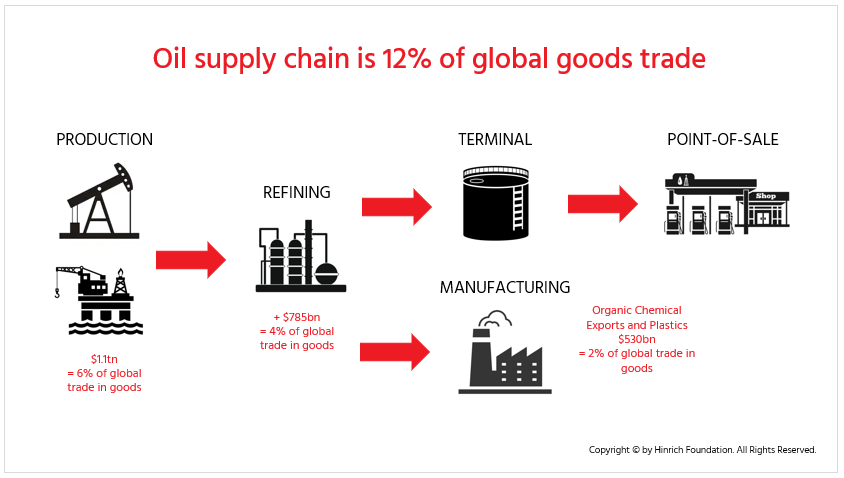

The global trade in oil and its derivatives, that accounts for up to one in eight dollars’ worth of international trade, could be a poster-child of all that is virtuous about trade; an example of comparative advantage, stemming from different factor endowments, enhancing economic efficiency and breeding interdependence among nations. Instead, it is synonymous with rent seeking, state intervention, cartelization, geopolitics and the pleadings of vested interest groups.

As US oil producers face mounting financial pressure from the oil war, calls for policy action will increase.

This article explores the significance of the oil trade, and the stresses and benefits that the Saudi-Russian oil war will bring and the potential for policy action.

How an oil war sent oil prices crashing

Managed supply from OPEC and Russia has accommodated the rise of US oil production at prices compatible with profitability in the US

From 2014 onwards, the rise of US shale oil production induced by high prices and technological innovation, started to have a dramatic impact on the supply-demand balance for oil.

From a relatively stable range of USD100-120/bbl in the aftermath of the GFC, oil prices crashed towards USD40/bbl in 2016. The response from the oil cartel was to bring Russia (which is not an OPEC member) into the cartel’s fold as an observer nation and reduce supply. The bulk of the supply cut was taken by Saudi Arabia.

The breakdown of OPEC+ cooperation and deteriorating demand have sent oil prices crashing

This relative supply restraint had the impact of stabilizing prices at around UD50/bbl. However, the economic slowdown in China caused by the Coronavirus led to a sharp drop in oil demand in the first two months of 2020. In early March 2020, cooperation between Russia and OPEC broke down and Saudi Arabia proceeded to engage in an oil war with the Russians by increasing supply into an already over-supplied market.

With Covid-19 now having a severe impact on the EU, demand conditions are likely to deteriorate further and compound the impacts of the oil war. Spot oil prices are now trading below USD30/bbl and futures contract for 2025 have come down to the low USD40s.

The oil war and lower oil prices will wipe out about 4% of global goods trade

Data source: WTO, UNCTAD

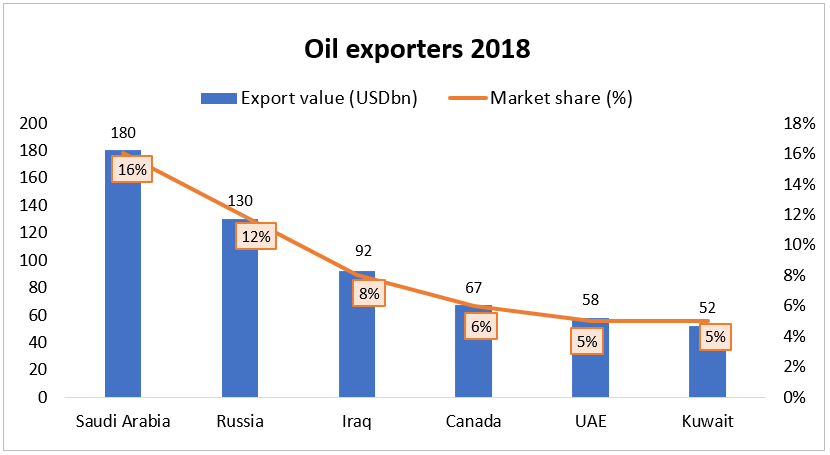

Crude oil exports account for about 6% of global goods trade

Crude oil exports in 2018 totaled about USD1.1 trillion, accounting for nearly 6% of global trade in goods. USD485bn or 43% of the total came from the Middle East. Saudi Arabia was the largest exporter accounting for 16% of the global total or USD180bn, with Russia second at USD130bn or 12%. Fifteen countries accounted for the lion’s share – about 80% of the total.

Data source: WTO, UNCTAD

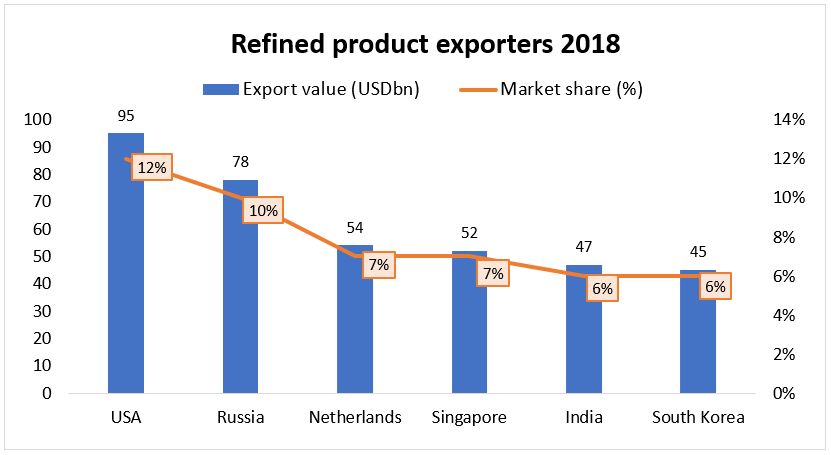

When combined with trade in refined products that share rises to about 10%

Refined petroleum product exports accounted for another USD785bn of trade, or 4% of the total trade in goods.

While Saudi Arabia is the largest exporter of crude oil, it is way down the list of exporters of refined product at number 10 with a 3% market share or USD26bn. Russia, the number 2 crude exporter, is also the number 2 refined product exporter with a market share of 10%, worth USD78bn.

Most major exporters of refined products do not feature in the top 15 crude exporting countries. The Netherlands, China, Korea, Singapore and India are large exporters of refined products but are net importers of crude.

Data source: WTO, UNCTAD

Chemicals and plastics derived from oil take the share of global goods trade to 12%

Moving further down the value chain, global organic chemical exports total about USD450bn and global plastic exports total around USD80bn.

Hence, crude oil and derived products account for a very significant part of global trade. Furthermore, many countries other than just oil producers, have significant industries that use oil as a key input and their competitiveness is dependent on accessing oil at a globally competitive price. Oil war impacts will therefore be significant.

The oil war will reduce trade imbalances

Lower oil prices should reduce current account surpluses among the big hydrocarbon producing economies.

The big oil and gas exporters, such as Saudi Arabia, Russia, Kuwait and Norway are among the perennial current account surplus countries. The cartelization of oil production from 1960 onwards was aimed at extracting rents from the global economy and it has been successful. Vigorous price competition should result in smaller current account surpluses for the big oil and gas exporting nations.

In fact, at USD30/bbl many oil producing countries will run current account deficits if there is no corresponding fall in imports, which is likely, but nevertheless current account imbalances will be substantially reduced by the fall in oil price.

However, some of the biggest oil importers are the mercantilist manufacturing countries.

Among the largest oil importing countries, however, are also the mercantilist manufacturing countries such as China, Japan, Germany and South Korea that are also perennial current account surplus countries.

These countries will receive a terms of trade boost in the form of lower oil input prices. In a competitive market for manufactured goods, the lower cost of oil should be reflected in lower prices of manufactured exports particularly those for which oil derivatives are big inputs such as plastics, petrochemicals and tires but also more generally through the knock-on impact on logistics and components.

If manufactured goods deflation follows oil’s lead, trade positions should move closer to balance

This deflationary impact of lower oil prices may or may not come to fruition. China for example, does not necessarily let lower oil prices feed through to oil users. Assuming oil price deflation does feed through to manufactured goods deflation, then some of the perennial current account deficit countries – both developed (such as the Anglo-Saxon economies and peripheral Europe) and emerging (such as Turkey and India) – may well see their terms of trade improve.

The net result of the price war in oil may be a significant reduction in external imbalances with a move back towards equilibrium, which would provide a very necessary credibility boost to the multilateral trading system.

Over the past decade, Russia, Saudi Arabia, Norway and Kuwait have run a combined current account surplus totaling about USD2 trillion, reflecting high oil prices, undervalued exchange rates and a process of foreign reserve accumulation that has prevented the necessary economic adjustments of high exchange rates and enhanced domestic consumption.

Crude oil consumers could save USD730bn, which equates to about 0.8% of global GDP

For context, global consumption of crude is running at about 85m bbl per day and if one includes Natural Gas Liquids (or NGL, a close substitute for crude), the price of which should perform more or less in line with crude prices, then world consumption is running at close to 100m bbl per day. A move from an oil price of USD50/bbl to USD30/bbl represents a USD730bn saving for oil consumers at the expense of oil producers. This is about 0.8% of global GDP, accounting for about one-third of the global trade imbalance.

The oil war will destroy the US shale oil industry and enhance consumer welfare, but benefits will be short-lived

The United States is the largest oil producer in the world

The United States finds itself in a unique position with regard to the trade impact of the oil price war. Unlike the EU and mercantilist manufacturers in North Asia, the US is not a big net oil importer, it has a more or less balanced trade position for crude and petroleum products, consequently there is no terms of trade benefit from a lower oil price, but it is a perennial current account deficit country and the largest oil producer in the world.

USD50/bbl prices are required to make a large part of US oil production viable

The big swing producer has become the United States and that is where the market will expect capacity destruction because the break-even price for much US capacity is above USD 50/bbl.

The biggest change in the oil market over the last decade has been the rise in US production, both of crude oil and Natural Gas Liquids. This production increase has turned the US into the largest oil producer and a modest net exporter of crude and refined products by some measures.

The growth in US production though, has come against a background of oil prices north of USD50/bbl and was induced by prices above USD100/bbl, at which shale oil production became viable. According to the Dallas Fed, USD50/bbl is the price that is required to make a large part of US oil production viable.

The USD20 drop in prices represents a USD150bn saving for consumers and the death of the shale oil industry

The oil war and recent fall in oil prices jeopardizes this production. In other words, a large part of US oil capacity is likely to be put out of business by the price war. Given the expansion of Saudi and Russian production, a potential capacity destruction of 3-4 million barrels per day is required even after a cyclical demand recovery.

The United States consumes about 20m bbl per day. At USD50/bbl this equates to an expenditure on crude or NGL of USD380bn (1.5% of GDP). The fall in prices from around USD50/bbl to USD30/bbl would reduce this expenditure by about USD150bn. This represents the increase in consumer welfare that free trade brings. At the new price however, the domestic oil industry will suffer severe cutbacks in production, employment and investment.

The new global price is clearly aimed at bringing this capacity destruction about in the US, and once it has happened the oil price will no doubt rise again towards the previous level.

If oil producers have their way, the consumer savings will be ephemeral

In economic theory, the lower price of oil produces an increase in the consumer surplus and a welfare gain in trade from the increased consumption the lower price induces. The loss of producer surplus in the home market is reduced by the re-deployment of the now underutilized resources in the oil industry elsewhere in the economy.

Experience suggests, however, that the re-deployment of labor and capital from one industry to another is far from instantaneous and in fact, a significant amount of capital investment in shale will just be written down completely.

Secondly, since reduced oil consumption is a goal of the “green agenda”, if the lower price induces a rise in demand, that could be viewed as a negative not a source of economic welfare gain.

Thirdly, the increase in consumer surplus may be ephemeral, as once the high-cost production has been eliminated, the cartelization of supply may return allowing overseas producers – OPEC & Russia – to extract an economic rent from US consumers.

The potential end game of the oil war envisioned by OPEC is one where marginal producers such as the US have to eliminate maybe 3m to 4m barrels per day of production, leaving the market in equilibrium at around USD60/bbl – a price high enough for OPEC to be highly profitable but low enough not to entice the re-emergence of more marginal US production.

The loss of say 3.5m bbl per day of US domestic production at a post capacity destruction price of USD55/bbl equates to USD70bn. This will potentially be added to the US import bill as the domestic production is replaced by imports, adding about 3% to total imports.

Covid-19 will aggravate the impact of the oil war for the US

The oil war and recent fall in oil prices, which is likely to feed through the value chain to refined products, chemicals and plastics, therefore has the potential to shrink the value of global trade by about 4% by virtue of its direct impact on oil exports and oil derivative exports.

Even without Covid-19, this would be a significant decline. The green agenda moderates the demand response to low prices, so capacity will need to be taken out. Given much of the world’s commitment to reducing dependence on fossil fuels, demand elasticity has likely fallen substantially.

Now, with Covid-19, and with low-cost producers outdoing each other to supply the market, as well as cyclically devastated demand and structurally slowing growth, and policy makers attempting to wean the world off oil, a prolonged period of low prices may well be upon us until capacity is destroyed.

Russia and Saudi Arabia will make significant gains

Russia can take the pain, but domestic capital flight may bring it back to the negotiation table

In 2019, Russia exported about USD200bn of oil, gas and petroleum products. The preliminary current account surplus for the year was about USD70bn. Hence, if everything remained the same but export prices for oil related exports were to fall 35%, the current account surplus would fall to zero. This need not be a problem since the country has foreign exchange reserves of about USD450bn which represents about 25% of GDP but if domestic capital flight sets in, as was the case in 1998, then Russia might be enticed to change its policy and come back to the table for talks with the OPEC cartel. Russia’s fiscal breakeven is significantly lower than Saudi Arabia’s at about USD50/bbl.

For Saudi Arabia, fiscal austerity will be a necessary tradeoff to achieve longer term goals

Saudi Arabia’s oil exports represent a higher proportion of GDP than Russia’s, by virtue of the fact that Saudi GDP is about half of Russia’s (USD785bn for Saudi vs USD1.6 trillion for Russia). Saudi Arabia has similarly sized foreign reserves to Russia but its overall Net International Investment Position (NIIP) is superior to Russia’s.

The fiscal breakeven oil price for Saudi Arabia is about USD80/bbl. Given, that revenue derived from oil accounts for 90% of Saudi Arabia’s fiscal revenue, a further bout of fiscal austerity would seem unavoidable with oil prices at current levels. The austerity arising from the oil war will likely prove unpopular. Russia’s fiscal breakeven is significantly lower than Saudi Arabia’s at about USD50/bbl. The key point though, is that both Saudi Arabia and Russia will feel significant economic pain but both countries seem prepared to take the short-term pain to achieve their longer-term goals.

While the consensus view is that they are having a price war between themselves, it is actually more likely that US capacity will fall victim to lower prices before Russian or Saudi Arabia change policy direction.

Policy responses to the oil war in the United States

In designing a policy response to the oil war and price collapse, there are number of issues that are of importance to the United States.

Favoring domestic supply would result in a mismatch between supply and demand

Self-sufficiency, as measured by balance in the import and export of oil and petroleum products, is not quite the same as achieving splendid isolation. Some US oil is more suited to overseas refineries and some foreign oil is better used in US refineries, so a balanced trade account does not obviate the need to trade.

Controlling prices to protect US producers would hurt the US economy

Secondly, given that oil is a feedstock into so many different economic activities, any attempt to shield domestic production from low global prices at the expense of oil users would be to the enormous disadvantage of the whole US economy and is therefore a non-starter. These factors would appear to preclude import protection as a policy option.

Three key policy objectives

If the government does have a role to play in the energy industry, three policy objectives would appear to make sense.

- Firstly, to emphasize demand reduction through efficiency enhancement rather than subsidizing or protecting relatively expensive supply.

- Secondly, promoting and encouraging technological innovation through R&D to lower the costs of shale oil extraction, thus lowering the price ceiling to which oil prices might return when demand normalizes and the production war between Russia and Saudi Arabia ends.

- Thirdly, promoting alternative and sustainable (renewable) energy sources.

The greatest fear for those promoting the transition to a low carbon economy, is that lower oil prices set this back.

However, an alternative outcome may offer a silver lining. Because the price war actually throws American energy independence into doubt, it could actually turn out to be a catalyst for policies to promote greater energy efficiency and higher usage of non-fossil energy sources.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).